Why does having a higher deductible lower your insurance premiums? This question sparks a crucial conversation about the intricate relationship between deductibles and insurance costs. By exploring this topic, we uncover the mechanisms that determine the balance between risk management and financial savings for policyholders.

Understanding the interplay between deductibles and premiums empowers individuals to make informed decisions when selecting insurance plans that align with their financial circumstances and risk tolerance. As we delve into the intricacies of this subject, we will uncover the advantages and considerations associated with choosing a higher deductible, ultimately enabling you to optimize your insurance coverage.

Deductible Overview

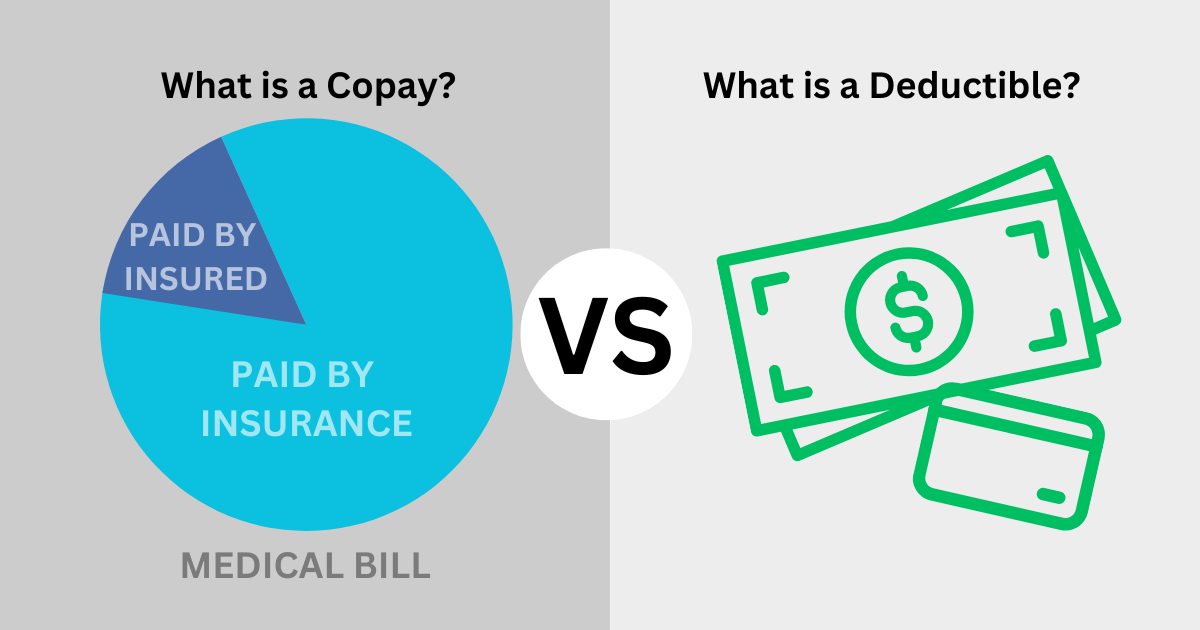

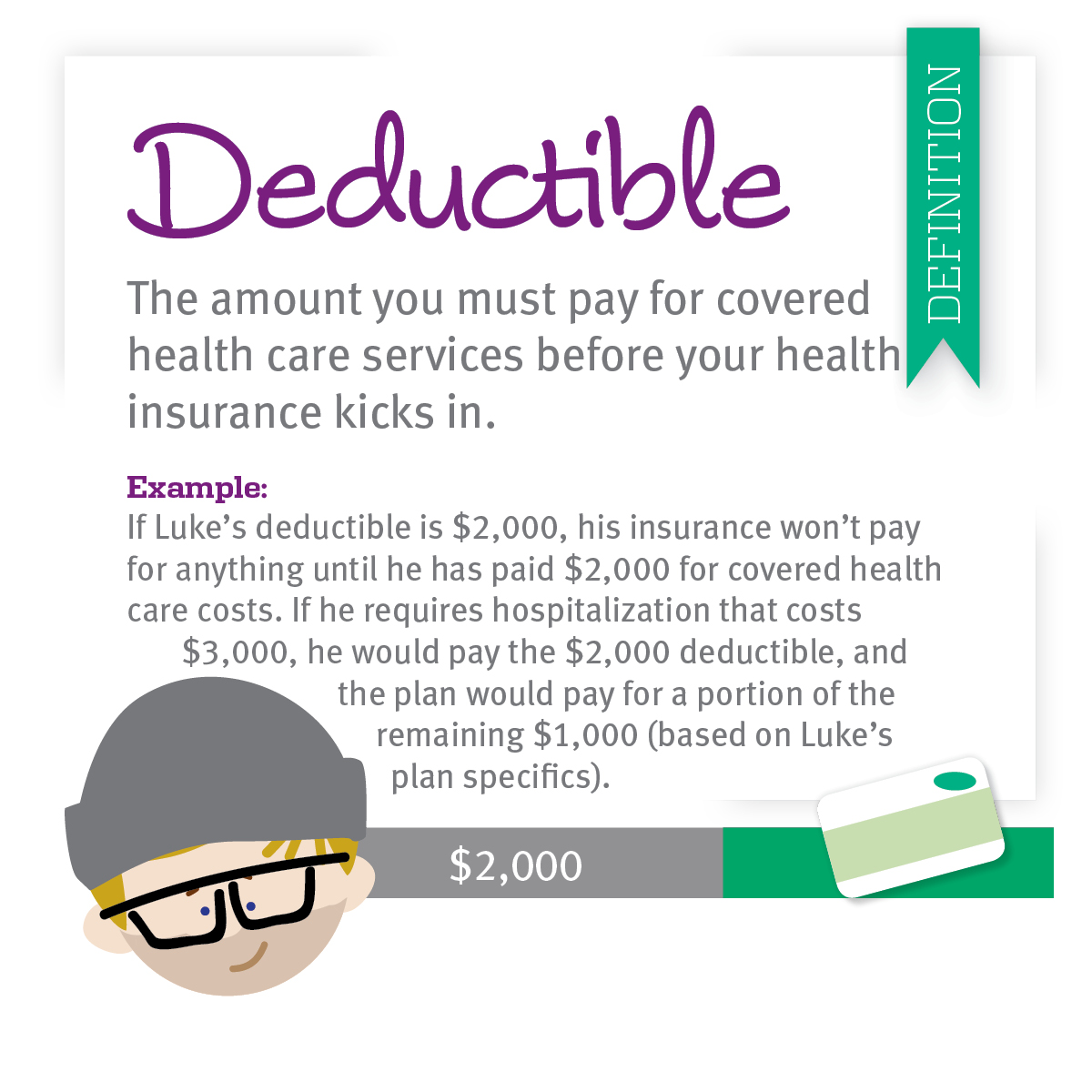

An insurance deductible is a specific amount that you, the policyholder, agree to pay out-of-pocket before your insurance coverage kicks in. It’s a way for insurance companies to share the risk with you and lower your premiums.

For example, let’s say you have a car insurance policy with a $500 deductible. If you get into an accident and the damage to your car is $1,000, you would be responsible for paying the first $500, and your insurance would cover the remaining $500.

Deductible Options

Insurance companies typically offer a range of deductible options, and the higher the deductible you choose, the lower your premium will be. This is because the insurance company is taking on less risk by having you pay more out-of-pocket before coverage kicks in.

However, it’s important to choose a deductible that you can afford to pay in the event of a claim. If you choose a deductible that is too high, you may find yourself struggling to pay for repairs or medical expenses if you need to file a claim.

Impact of Deductible on Premiums

Increasing the deductible lowers insurance premiums because it shifts more of the financial risk from the insurance company to the policyholder. This means that the insurance company is less likely to have to pay out claims, which in turn allows them to offer lower premiums.

Higher deductibles lower insurance premiums by shifting more of the initial financial burden to the policyholder. This can be a viable option for those who can afford to pay higher out-of-pocket costs in the event of a medical emergency. Hospital indemnity insurance , which provides a fixed payout for covered hospital stays, can complement a high-deductible health plan by providing additional financial protection.

By opting for a higher deductible, individuals can reduce their monthly insurance premiums while still maintaining access to necessary medical care.

The relationship between deductible and premiums can be illustrated with a simple calculation. Let’s say you have a car insurance policy with a $500 deductible. This means that you would be responsible for paying the first $500 of any claim. If you increase your deductible to $1,000, you would be responsible for paying the first $1,000 of any claim. In exchange for taking on this additional risk, the insurance company would likely offer you a lower premium.

Here is an example to illustrate the relationship between deductible and premiums:

- Policy with a $500 deductible: Premium = $1,000

- Policy with a $1,000 deductible: Premium = $800

As you can see, increasing the deductible from $500 to $1,000 resulted in a $200 decrease in the premium.

Risk Management and Deductibles: Why Does Having A Higher Deductible Lower Your Insurance Premiums?

Deductibles play a crucial role in risk management for insurance companies. They act as a buffer against small, frequent claims, allowing insurers to focus their resources on larger, more costly events.

Having a higher deductible lowers insurance premiums because it reduces the amount the insurer pays out in claims. This can be especially beneficial for young drivers like 18-year-olds who typically pay higher premiums due to their inexperience and higher risk of accidents.

By choosing a higher deductible, they can lower their monthly premiums and save money in the long run, even if they have to pay more out-of-pocket for smaller claims.

Higher deductibles encourage policyholders to assume more risk, as they are responsible for a greater portion of the claim costs. This incentivizes policyholders to take steps to prevent or minimize losses, thereby reducing the overall risk exposure for the insurance company.

When it comes to insurance premiums, there is a trade-off between deductibles and premiums. A higher deductible means a lower premium, and vice versa. This is because insurance companies are taking on less risk when you have a higher deductible.

You are agreeing to pay more out of pocket before the insurance company starts to pay, so they are willing to charge you less for the coverage. To learn more about life insurance and other options available, check out which type of life insurance is the better option.

If you are considering raising your deductible, it is important to weigh the pros and cons carefully. On the one hand, you will save money on your premiums. On the other hand, you will have to pay more out of pocket if you need to make a claim.

Impact of Deductibles on Claims Frequency and Severity

Higher deductibles have been shown to reduce both the frequency and severity of claims. Policyholders with higher deductibles are more likely to postpone or avoid filing claims for minor incidents, as the cost of the deductible would exceed the value of the claim. Additionally, policyholders may take steps to reduce the risk of loss, such as installing security systems or maintaining their vehicles properly, to avoid having to pay the deductible.

Benefits of Higher Deductibles

Choosing a higher deductible can bring several advantages to policyholders. One of the most significant benefits is the reduction in insurance premiums. By agreeing to pay a larger portion of the initial expenses out-of-pocket, policyholders can qualify for lower monthly or annual premiums. This can result in substantial savings over the life of the policy.

Furthermore, higher deductibles encourage policyholders to be more financially responsible. Knowing that they will have to cover a higher amount of expenses before insurance coverage kicks in, policyholders may be more cautious about filing claims for minor incidents. This can lead to reduced overall claims costs for insurance companies, which in turn can translate into even lower premiums for policyholders in the long run.

Financial Implications for Policyholders

While higher deductibles offer the potential for lower premiums, it is essential for policyholders to carefully consider their financial situation before making a decision. Choosing a deductible that is too high can put a strain on their finances in the event of a covered incident. Policyholders should assess their ability to pay the deductible and ensure they have sufficient emergency funds to cover unexpected expenses.

It is also important to consider the frequency and severity of potential claims. For individuals or businesses with a high likelihood of filing claims, a lower deductible may be more suitable. Conversely, those who rarely make claims may find that a higher deductible is a more cost-effective option.

Considerations for Choosing a Deductible

Selecting an appropriate deductible is crucial for optimizing insurance coverage and minimizing financial burden. Several factors should be considered to make an informed decision:

Financial Situation

- Emergency fund: Ensure you have sufficient savings to cover potential out-of-pocket expenses associated with a higher deductible.

- Budget: Consider your regular expenses and income to determine if you can comfortably afford the higher premiums associated with a lower deductible.

- Long-term goals: If you have significant financial goals, such as saving for retirement or purchasing a home, a higher deductible can free up more funds for these priorities.

Risk Tolerance

- Frequency of claims: If you frequently file claims, a lower deductible may be more beneficial, despite higher premiums.

- Severity of claims: Consider the potential severity of potential claims. A higher deductible can provide significant savings if you have a low risk of experiencing major claims.

- Personal comfort level: Ultimately, the deductible should align with your personal comfort level and risk tolerance.

Final Summary

In conclusion, the relationship between higher deductibles and lower insurance premiums is a delicate balance that requires careful consideration. By understanding the impact of deductibles on risk management and financial implications, individuals can make informed choices that align with their specific needs and circumstances. Remember, the optimal deductible is the one that strikes the right equilibrium between affordability and peace of mind, ensuring that you are adequately protected without breaking the bank.

1 thought on “Why a Higher Deductible Lowers Your Insurance Premiums: A Comprehensive Explanation”