What is AD&D insurance? It’s a specialized type of insurance that provides financial protection against accidental death and dismemberment. Learn about its benefits, eligibility, and claims process to make informed decisions about your coverage.

AD&D insurance offers peace of mind, ensuring financial stability for loved ones in the event of an unexpected tragedy.

Overview of AD&D Insurance

Accidental death and dismemberment (AD&D) insurance is a type of insurance that provides financial protection in the event of an accidental death or dismemberment. It is designed to provide a lump sum payment to the beneficiary in the event of the insured person’s death or dismemberment due to an accident.

AD&D insurance is typically offered as a rider to a life insurance policy, but it can also be purchased as a stand-alone policy. There are two main types of AD&D insurance:

- Specified peril coverage: This type of coverage only provides benefits if the accidental death or dismemberment is caused by a specific peril, such as a car accident or a fall.

- Blanket coverage: This type of coverage provides benefits for any accidental death or dismemberment, regardless of the cause.

The amount of coverage provided by an AD&D insurance policy will vary depending on the policyholder’s age, health, and occupation. However, most policies will provide a lump sum payment of between $10,000 and $100,000.

Accidental death and dismemberment (AD&D) insurance provides financial protection in the event of accidental death or dismemberment. While it is often included as an optional rider on life insurance policies, it is distinct from voluntary life insurance , which provides a death benefit regardless of the cause of death.

AD&D insurance specifically covers accidents, and its benefits can be used to cover medical expenses, lost income, or other financial obligations resulting from the accident.

AD&D insurance can be a valuable form of protection for individuals who are concerned about the financial impact of an accidental death or dismemberment. It can provide peace of mind knowing that their loved ones will be financially secure in the event of their untimely death.

Accidental death and dismemberment (AD&D) insurance provides coverage for accidental injuries or death. While it can be a valuable addition to your financial plan, it’s important to consider top-rated life insurance policies that offer comprehensive protection for your loved ones.

AD&D insurance typically covers accidental events, while life insurance provides financial security in the event of death from any cause.

Eligibility and Coverage

Eligibility for AD&D insurance typically requires that the insured individual is employed by a company that offers the coverage as a group benefit. Coverage may also be available to individuals through professional organizations or associations.

Accident, Disability, and Dismemberment (AD&D) insurance provides coverage for specific accidents and injuries, including dismemberment, paralysis, or death. While it offers protection against unexpected events, it’s important to consider that AD&D insurance is typically more limited than voluntary life insurance , which provides a death benefit to beneficiaries.

AD&D insurance can complement voluntary life insurance by providing additional coverage for specific incidents.

The level of coverage available under an AD&D policy varies depending on the policyholder’s occupation and the specific terms of the policy. Common coverage levels include:

- Basic coverage: This level provides a lump sum benefit in the event of accidental death or dismemberment.

- Enhanced coverage: This level provides a higher lump sum benefit and may also include benefits for other types of injuries, such as paralysis or loss of sight.

Exclusions and Limitations

AD&D insurance policies typically exclude coverage for:

- Deaths or injuries resulting from natural causes

- Deaths or injuries resulting from suicide or self-inflicted harm

- Deaths or injuries resulting from war or military service

- Deaths or injuries resulting from criminal activity

Policies may also have limitations on the amount of coverage available for certain types of injuries or deaths.

Premiums and Costs

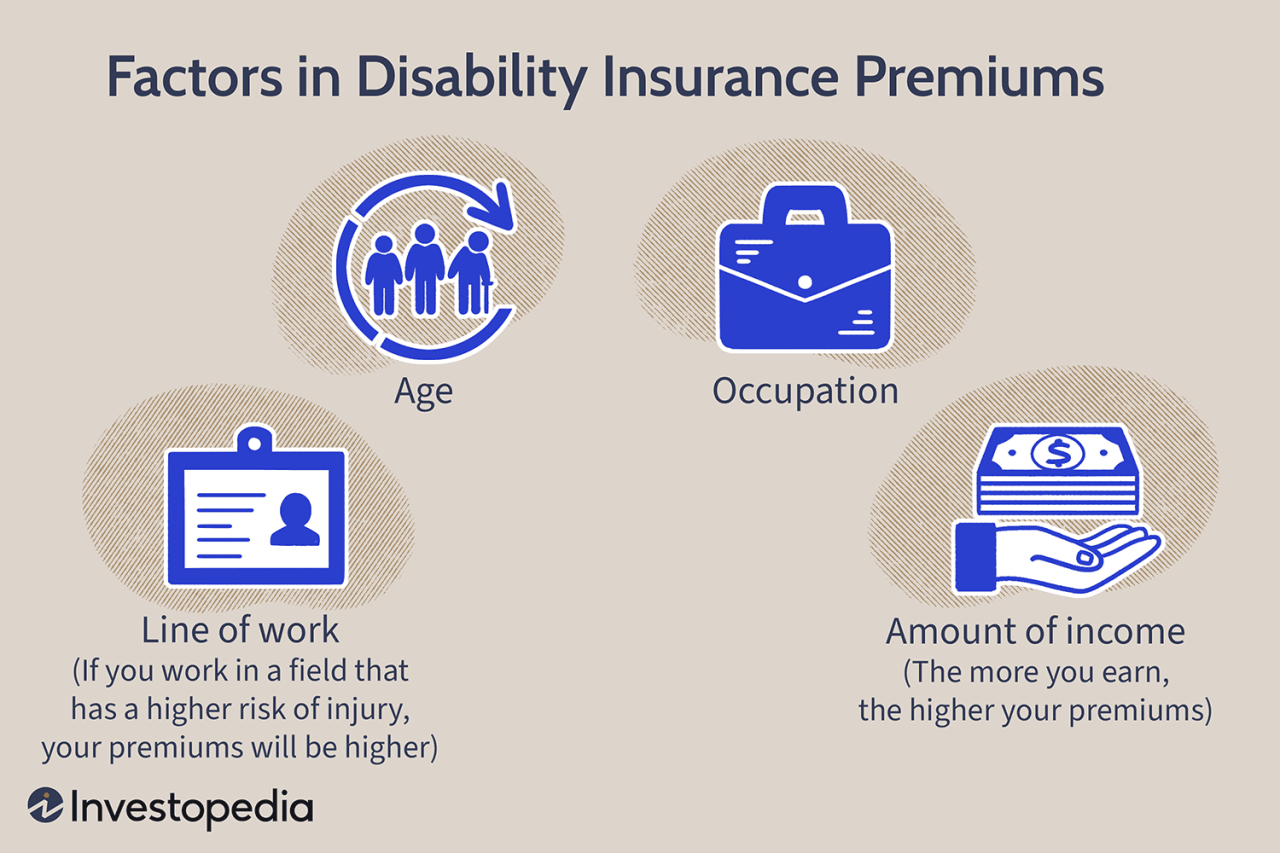

The cost of AD&D insurance varies depending on several factors, including the amount of coverage, the age of the insured person, and the occupation of the insured person.

AD&D insurance premiums are typically paid monthly or annually. Some insurers may offer discounts for paying the premium in full upfront.

Tax Implications, What is ad&d insurance

AD&D insurance premiums are not tax-deductible. However, the benefits received from an AD&D insurance policy are not taxable.

Claims Process: What Is Ad&d Insurance

Filing an AD&D insurance claim involves specific steps and documentation to ensure a smooth and efficient process. Understanding the claims process helps policyholders navigate the procedure effectively and maximize their benefits.

The steps involved in filing an AD&D insurance claim typically include:

- Notify the insurance company: Promptly report the incident or accident that led to the injury or death to the insurance company.

- Complete the claim form: Obtain the claim form from the insurance company and fill it out accurately and completely, providing details of the incident and the policyholder’s information.

- Gather supporting documentation: Collect necessary documents to support the claim, such as medical records, police reports, witness statements, and proof of identity.

- Submit the claim: Submit the completed claim form and supporting documentation to the insurance company for review and processing.

- Review and decision: The insurance company will review the claim and make a decision on coverage and benefits based on the policy terms and conditions.

- Payment: If the claim is approved, the insurance company will issue payment to the beneficiary or policyholder.

Documentation Required

To support an AD&D insurance claim, policyholders are typically required to provide the following documentation:

- Medical records detailing the injury or death

- Police report or accident report

- Witness statements

- Proof of identity (e.g., driver’s license, passport)

- Policy information (e.g., policy number, coverage details)

Time Frame for Processing

The time frame for processing AD&D insurance claims varies depending on the insurance company and the complexity of the claim. Generally, policyholders can expect the following time frames:

- Initial review: The insurance company typically conducts an initial review of the claim within a few days of receiving it.

- Investigation and decision: The insurance company may conduct an investigation to gather additional information and make a decision on coverage and benefits, which can take several weeks or months.

- Payment: Once the claim is approved, the insurance company typically issues payment within a few weeks.

5. Comparisons and Considerations

AD&D insurance differs from other types of insurance in terms of coverage and purpose. Understanding these differences can help you make informed decisions about your insurance needs.

Compared to life insurance, AD&D insurance provides a limited coverage specifically for accidental death and dismemberment. Life insurance, on the other hand, offers broader coverage for death from any cause.

Advantages of AD&D Insurance

- Specific coverage for accidents: AD&D insurance provides financial protection in case of accidental death or dismemberment, which may not be covered by other insurance policies.

- Relatively low premiums: AD&D insurance premiums are typically lower compared to other types of insurance, making it a more affordable option for coverage.

Disadvantages of AD&D Insurance

- Limited coverage: AD&D insurance only covers accidental death and dismemberment, excluding other causes of death or injury.

- Exclusions and limitations: AD&D policies may have exclusions or limitations for certain types of accidents or activities, such as high-risk sports or occupations.

Tips for Choosing the Right AD&D Insurance Policy

- Assess your risk: Consider your lifestyle and occupation to determine if AD&D insurance is necessary for you.

- Compare policies: Research different AD&D insurance policies from various providers to compare coverage, premiums, and exclusions.

- Read the policy carefully: Before purchasing an AD&D insurance policy, thoroughly review the policy document to understand its terms, conditions, and limitations.

End of Discussion

AD&D insurance serves as a valuable financial safety net, providing peace of mind and financial security in the face of life’s uncertainties. By understanding its coverage, eligibility, and claims process, individuals can make informed decisions about their insurance needs and ensure adequate protection for themselves and their loved ones.

2 thoughts on “Understanding AD&D Insurance: Coverage, Eligibility, and Claims”