What are the two types of life insurance policies? This question sets the stage for an enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. In this comprehensive guide, we delve into the intricacies of life insurance policies, exploring their distinct characteristics, advantages, and disadvantages. By unraveling the complexities of term life insurance and whole life insurance, we empower individuals to make informed decisions about their financial futures.

Types of Life Insurance Policies

Life insurance policies provide financial protection to your loved ones in the event of your untimely demise. There are two main types of life insurance policies: term life insurance and whole life insurance.

Understanding the two types of life insurance policies, namely term and permanent, is crucial. However, there’s also voluntary life insurance, a benefit offered by employers or organizations where employees can choose additional coverage beyond the basic group policy. Understanding voluntary life insurance meaning can help you determine the best life insurance option for your needs, complementing the coverage provided by term or permanent policies.

Term Life Insurance

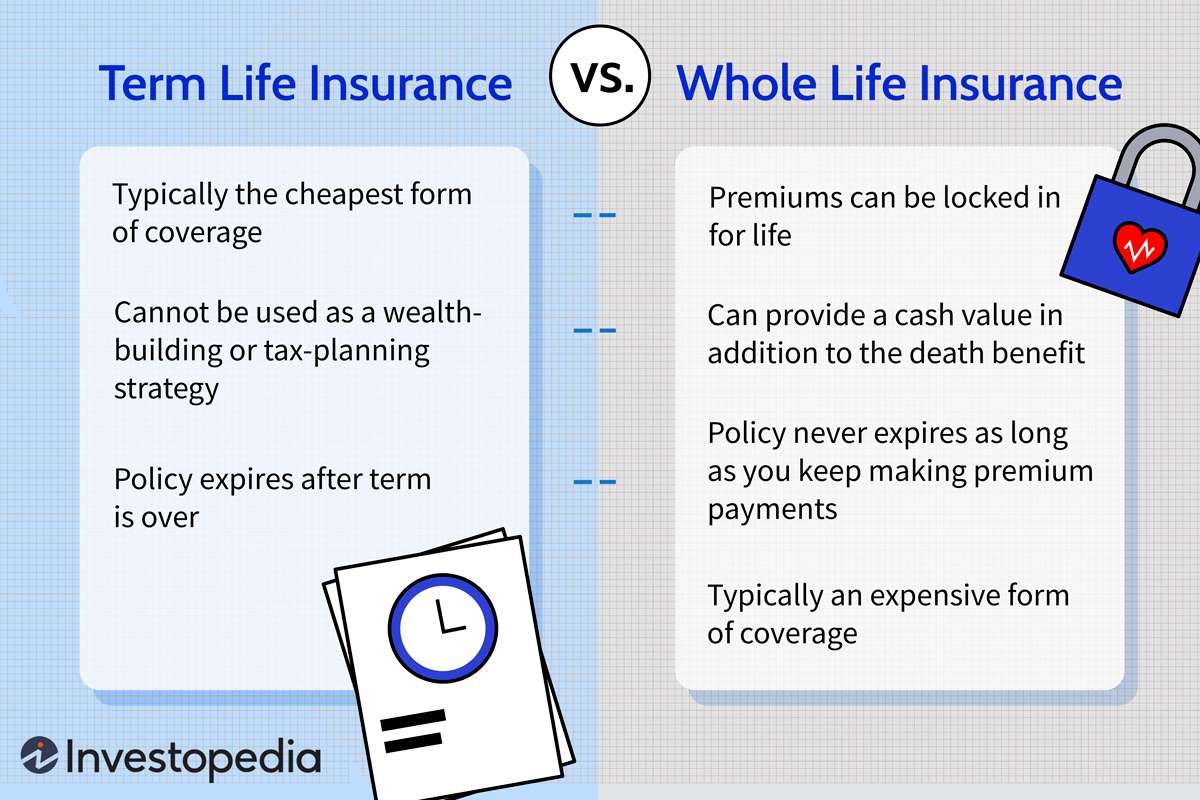

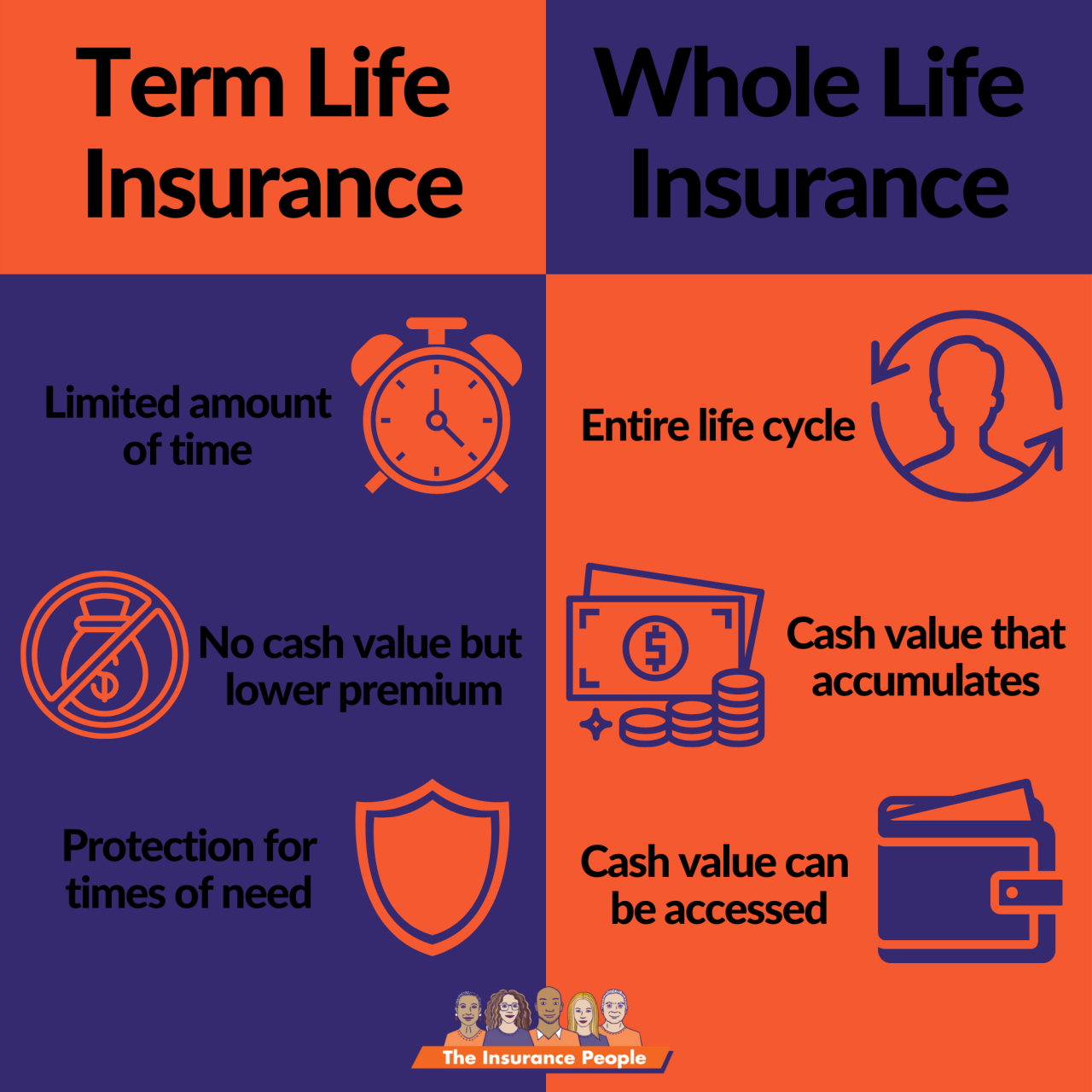

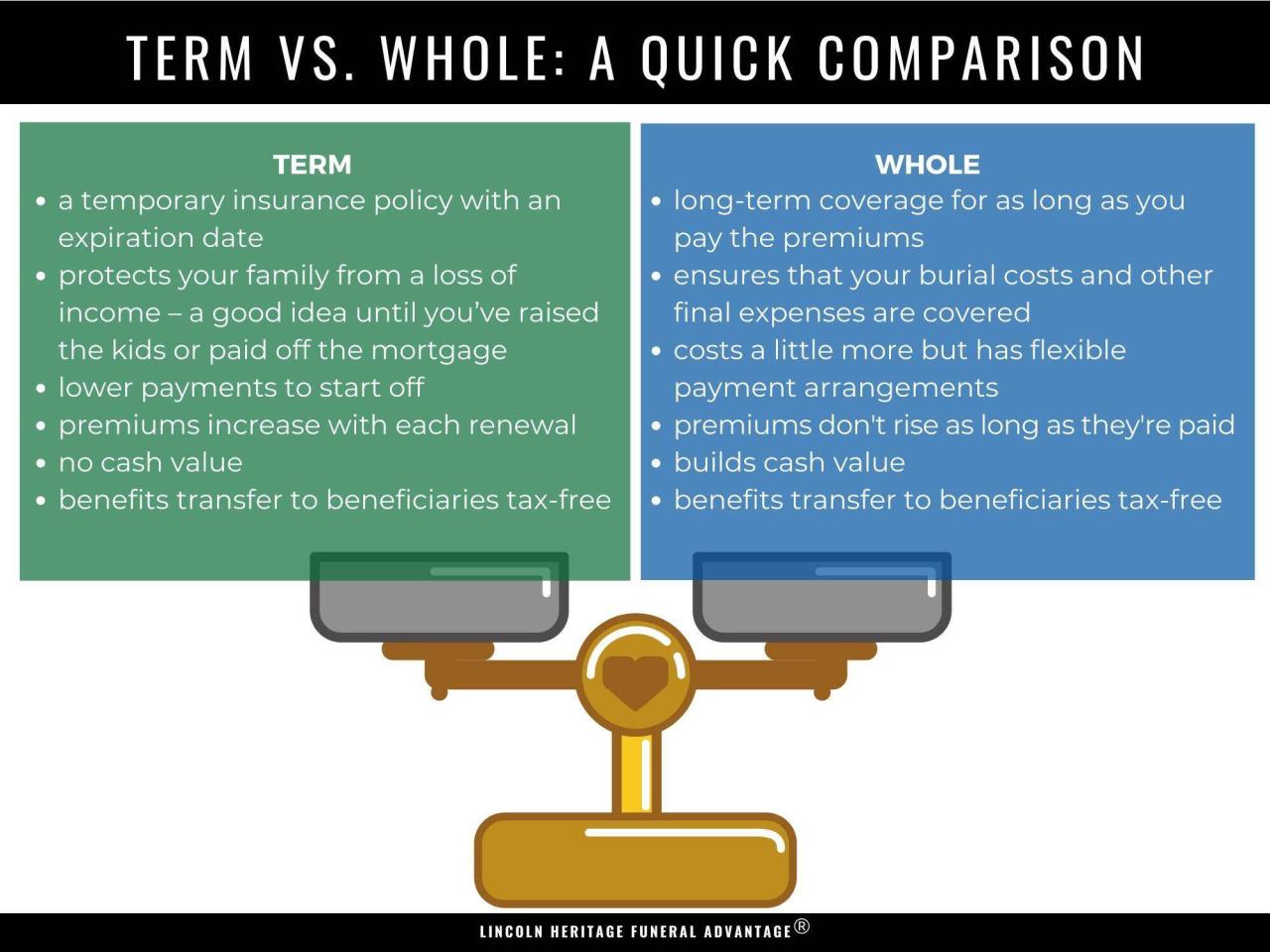

- Provides coverage for a specific period, such as 10, 20, or 30 years.

- Premiums are typically lower than whole life insurance.

- No cash value accumulation.

Whole Life Insurance

- Provides coverage for your entire life, as long as you continue to pay the premiums.

- Premiums are typically higher than term life insurance.

- Builds cash value over time, which can be borrowed against or withdrawn.

| Feature | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Coverage Period | Specific period (e.g., 10, 20, 30 years) | Entire life |

| Premiums | Lower | Higher |

| Cash Value | No cash value accumulation | Builds cash value over time |

| Flexibility | Less flexible | More flexible (can borrow against or withdraw cash value) |

| Purpose | Temporary protection (e.g., mortgage, income replacement) | Long-term protection and savings (e.g., retirement, inheritance) |

Term Life Insurance

Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years. It is typically more affordable than whole life insurance, but it does not offer the same benefits, such as cash value accumulation.

Life insurance policies are broadly categorized into two types: term life insurance and whole life insurance. While term life insurance provides coverage for a specified period, whole life insurance offers lifelong protection. Understanding the difference between life insurance and accidental death and dismemberment (AD&D) insurance is crucial as AD&D insurance specifically covers accidental death or dismemberment.

Returning to the topic of life insurance types, whole life insurance also includes a cash value component that grows over time.

Advantages of Term Life Insurance

- Affordable: Term life insurance is typically more affordable than whole life insurance, making it a good option for those on a budget.

- Flexibility: Term life insurance can be purchased for a variety of terms, making it a good option for those who need coverage for a specific period of time.

- No cash value accumulation: Term life insurance does not offer cash value accumulation, which means that the policyholder will not receive any money back if they outlive the policy term.

Disadvantages of Term Life Insurance, What are the two types of life insurance policies

- Temporary coverage: Term life insurance only provides coverage for a specific period of time. If the policyholder outlives the policy term, they will no longer be covered.

- No cash value accumulation: Term life insurance does not offer cash value accumulation, which means that the policyholder will not receive any money back if they outlive the policy term.

- Can be more expensive later in life: Term life insurance premiums can increase as the policyholder gets older, making it more expensive to maintain coverage later in life.

Examples of Situations Where Term Life Insurance Is Suitable

- Young families: Term life insurance can be a good option for young families who need affordable coverage for a specific period of time, such as until the children are grown and out of the house.

- People with temporary financial obligations: Term life insurance can be a good option for people with temporary financial obligations, such as a mortgage or car loan.

- People who are not in good health: Term life insurance can be a good option for people who are not in good health and may not be able to qualify for whole life insurance.

Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides coverage for the entire life of the insured person. It is a cash value policy, which means that a portion of the premiums paid into the policy is invested and grows over time. The cash value can be borrowed against or withdrawn, but doing so will reduce the death benefit.

The two main types of life insurance policies are term life insurance and whole life insurance. Term life insurance provides coverage for a specific period of time, while whole life insurance provides coverage for the entire life of the insured.

Supplemental life insurance is a type of life insurance that provides additional coverage beyond the limits of an existing policy. It can be used to cover specific expenses, such as funeral costs or outstanding debts. For more information on supplemental life insurance, visit here.

Whole life insurance premiums are typically higher than term life insurance premiums, but the coverage is guaranteed for life, regardless of the insured person’s health. This makes whole life insurance a good option for people who want to ensure that their loved ones will be financially secure in the event of their death.

Advantages of Whole Life Insurance

- Guaranteed coverage for life

- Cash value that grows over time

- Death benefit that is not affected by the insured person’s health

- Can be used as collateral for a loan

Disadvantages of Whole Life Insurance

- Higher premiums than term life insurance

- Cash value growth may be slow

- Death benefit may not keep pace with inflation

- May not be suitable for people who do not need coverage for their entire life

Situations Where Whole Life Insurance Is Suitable

Whole life insurance is a good option for people who:

- Want guaranteed coverage for life

- Have a high net worth and want to pass on an inheritance to their heirs

- Need a policy that can be used as collateral for a loan

- Are not concerned about the higher premiums

Comparison of Term and Whole Life Insurance

Term life insurance and whole life insurance are the two main types of life insurance policies available. Both offer a death benefit to your beneficiaries, but they have different features and benefits.

Term life insurance is a temporary policy that provides coverage for a specific period of time, such as 10, 20, or 30 years. If you die during the policy term, your beneficiaries will receive the death benefit. However, if you outlive the policy term, your coverage will end and you will not receive any benefits.

Whole life insurance is a permanent policy that provides coverage for your entire life. Your beneficiaries will receive the death benefit whenever you die, regardless of when it occurs.

Factors to Consider When Choosing Between Term and Whole Life Insurance

There are a number of factors to consider when choosing between term and whole life insurance, including:

- Your age

- Your health

- Your financial situation

- Your investment goals

Wrap-Up: What Are The Two Types Of Life Insurance Policies

As we conclude our exploration of the two main types of life insurance policies, it is evident that both term life insurance and whole life insurance serve unique purposes. The choice between these policies ultimately depends on individual circumstances, financial goals, and risk tolerance. Whether seeking temporary coverage or lifelong protection, understanding the nuances of each policy is paramount. By carefully considering the information presented in this guide, individuals can confidently navigate the complexities of life insurance and make decisions that align with their long-term financial well-being.

1 thought on “What Are the Two Main Types of Life Insurance Policies?”