Top-rated life insurance policies – Navigating the world of life insurance can be daunting, but with the right information, you can find the top-rated policies that provide the best coverage and peace of mind. This comprehensive guide will delve into the key features, benefits, and coverage options of the most highly regarded life insurance policies in the market, empowering you to make an informed decision that aligns with your specific needs and financial goals.

From understanding the different types of policies and coverage options to evaluating the financial strength and stability of insurance companies, this guide will equip you with the knowledge to compare premiums and rates, ensuring you secure the best deal. We will also explore the importance of customer service and support, providing you with insights into the types of support offered by different insurance companies and how to evaluate their quality.

Premiums and Rates

Life insurance premiums are the payments you make to keep your policy active. The amount of your premium will depend on several factors, including your age, health, smoking status, and the amount of coverage you need.

When it comes to securing your financial future, top-rated life insurance policies offer peace of mind and protection for your loved ones. These policies provide a safety net in the event of an unexpected passing, ensuring that your family’s financial needs are met.

As you navigate the complexities of life insurance options, don’t miss out on the latest entertainment news. Head over to Who Went Home on Dancing with the Stars Tonight: A Shocking Elimination to catch up on the drama and surprises from the dance floor.

Afterwards, be sure to revisit the topic of top-rated life insurance policies to ensure you have the necessary coverage for your family’s well-being.

Factors Affecting Premiums

- Age: Younger people typically pay lower premiums than older people because they are considered to be a lower risk.

- Health: People with good health typically pay lower premiums than those with poor health.

- Smoking status: Smokers typically pay higher premiums than non-smokers because they are considered to be a higher risk.

- Amount of coverage: The more coverage you need, the higher your premium will be.

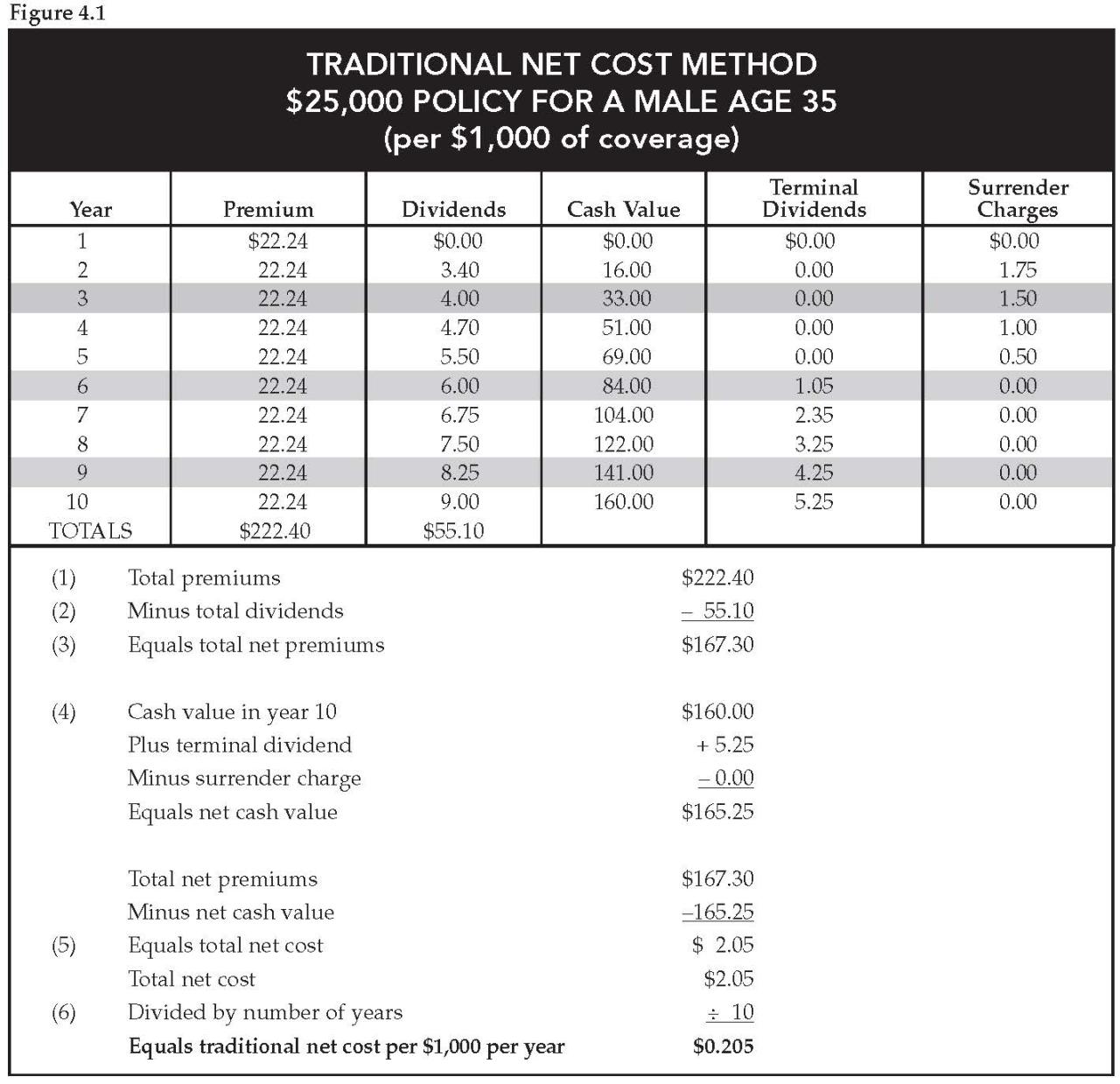

Comparing Premiums and Rates, Top-rated life insurance policies

When comparing premiums and rates, it is important to look at the following factors:

- The type of policy: Term life insurance policies typically have lower premiums than whole life insurance policies.

- The length of the policy: Shorter-term policies typically have lower premiums than longer-term policies.

- The riders you choose: Riders are optional add-ons that can increase your coverage. However, they can also increase your premium.

How to Find the Best Deal

The best way to find the best deal on life insurance is to shop around and compare quotes from different companies. You can also use an online life insurance calculator to get an estimate of your premium.

Top-rated life insurance policies offer financial protection and peace of mind for individuals and families. Among the most reputable insurers, Alpha stands out with its comprehensive coverage, competitive premiums, and exceptional customer service. By partnering with Alpha, policyholders can secure their loved ones’ financial well-being and ensure their legacy for years to come.

When comparing quotes, be sure to look at the following factors:

- The total cost of the policy: This includes the premium, as well as any other fees or charges.

- The coverage you need: Make sure the policy you choose provides enough coverage for your needs.

- The company’s reputation: Choose a company that has a good reputation for customer service and financial stability.

Financial Strength and Stability

The financial strength and stability of an insurance company are crucial factors to consider when choosing a life insurance policy. A financially stable company is more likely to be able to fulfill its obligations to policyholders, even in challenging economic times.

Financial strength ratings are assigned by independent rating agencies such as AM Best, Standard & Poor’s, and Moody’s. These ratings assess an insurance company’s financial condition, claims-paying ability, and overall risk profile.

Financial Ratings and Policyholder Benefits

Higher financial strength ratings generally indicate a lower risk of policyholder losses. This can translate into lower premiums, better policy terms, and more reliable coverage.

When considering top-rated life insurance policies, it’s crucial to evaluate their coverage, premiums, and customer service. While exploring these options, one may find inspiration in the journey of Brandon, a talented dancer on “Brandon Dances with the Stars: A Journey of Talent and Charisma” here.

His dedication and passion serve as a reminder to carefully assess and secure life insurance policies that provide unwavering protection and financial peace of mind.

Insurance companies with strong financial ratings are also more likely to have a track record of paying claims promptly and fairly. This can provide peace of mind for policyholders and their beneficiaries.

Top-rated life insurance policies provide financial security for your loved ones, ensuring their well-being in your absence. To stay informed about the latest developments in life insurance, you may find Dancing with the Stars 2024: A Comprehensive Guide to Voting Procedures and Contestant Analysis helpful.

This guide offers insights into the upcoming season, featuring voting procedures and in-depth contestant analysis. Returning to our focus on top-rated life insurance policies, it’s crucial to evaluate different plans and choose the one that aligns with your specific needs and financial goals.

Financial Strength Ratings Comparison

The following table compares the financial strength ratings of some of the top-rated life insurance companies:

| Company | AM Best Rating | Standard & Poor’s Rating | Moody’s Rating |

|---|---|---|---|

| AIG | A+ | AA- | Aa3 |

| MetLife | A+ | AA- | Aa3 |

| Prudential | A+ | AA- | Aa3 |

| State Farm | A++ | AAA | Aaa |

| USAA | A++ | AAA | Aaa |

As you can see, State Farm and USAA have the highest financial strength ratings, indicating a very low risk of policyholder losses. This makes them excellent choices for life insurance coverage.

Customer Service and Support

Customer service and support are crucial in life insurance as they directly impact the policyholder’s experience and satisfaction. Insurance companies offer various support channels, including phone, email, live chat, and online portals. The quality of customer service can be evaluated based on factors such as responsiveness, resolution time, and overall helpfulness of the representatives.

Types of Support Offered

– Phone support: Direct communication with a customer service representative, allowing for immediate assistance and clarification of complex queries.

– Email support: Convenient and asynchronous communication method, suitable for non-urgent inquiries or detailed documentation sharing.

– Live chat: Real-time online interaction with a representative, providing quick responses and efficient problem-solving.

– Online portals: Self-service platforms that enable policyholders to manage their accounts, view policy details, and submit claims online.

Evaluating Customer Service Quality

– Responsiveness: Measure the time it takes for representatives to respond to inquiries through different channels.

– Resolution time: Track the average time taken to resolve customer issues or concerns.

– Helpful and knowledgeable representatives: Assess the ability of representatives to provide clear and accurate information, address customer needs effectively, and demonstrate empathy.

– Personalized support: Evaluate whether the customer service experience is tailored to individual policyholder needs and preferences.

– Availability: Consider the hours of operation and the availability of support across different channels.

Epilogue: Top-rated Life Insurance Policies

Choosing the right life insurance policy is a crucial decision that can provide peace of mind and financial security for your loved ones. By leveraging the information and insights provided in this guide, you can navigate the complexities of life insurance with confidence, ensuring that you secure the best coverage to protect your family’s future.

2 thoughts on “Top-Rated Life Insurance Policies: A Comprehensive Guide to Finding the Best Coverage”