Members 1st Student Loan Refinance: Benefits And Application Tips – How can people get rid of their student loans and when is loan forgiveness possible? The statistics show just how deep in student loan debt America is, and the rates can be scary for individual borrowers. Fortunately, students can take advantage of income-based payment programs and public employee forgiveness programs to reduce their debt burden.

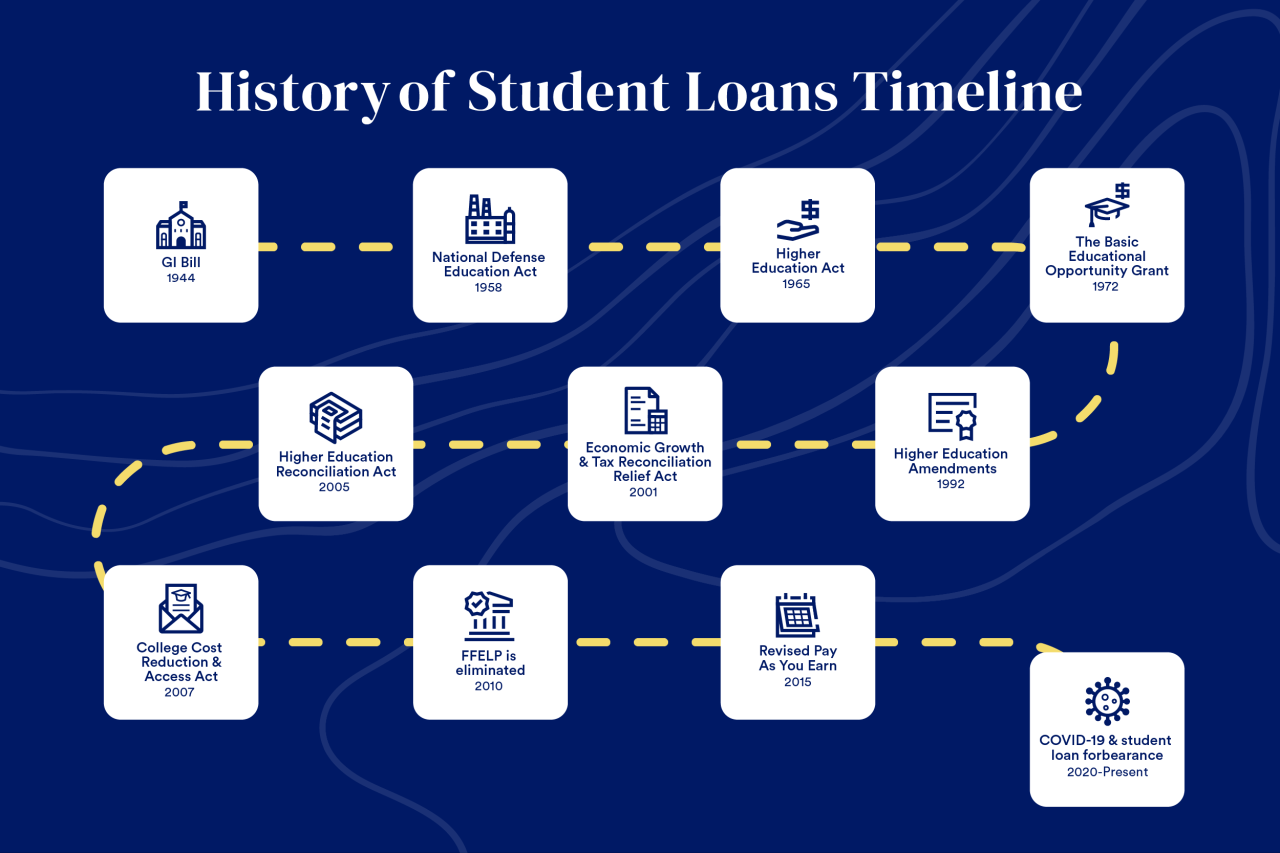

Only state direct loans and Stafford loans, which were replaced by direct loans in 2010, are eligible for forgiveness programs.

Members 1st Student Loan Refinance: Benefits And Application Tips

If you have other types of federal loans, you may be able to consolidate them into one consolidation loan, which can give you access to other income-based payment plan options. Non-federal loans from private lenders and payday lenders are not eligible for forgiveness.

How To Refinance Student Loans In 2024: The Complete Guide

In 2020, student loan borrowers who attended for-profit colleges and are seeking loan forgiveness because their school defrauded them or violated certain rules faced problems when former President Donald Trump vetoed a bipartisan resolution that would have repealed the new rules making it even more so. difficult to access loan forgiveness. The new, tougher rules went into effect on July 1, 2020.

In August 2022, the Biden administration, along with the US Department of Education, approved $32 billion to help more than 1.6 million student borrowers. However, in November 2022, federal courts issued orders blocking the student loan forgiveness program. On June 30, 2023, the Supreme Court ruled that the Biden administration did not have the authority to write off up to $20,000 in student loans per borrower.

The following special programs are still available and offer applications and student loan forgiveness for those who qualify.

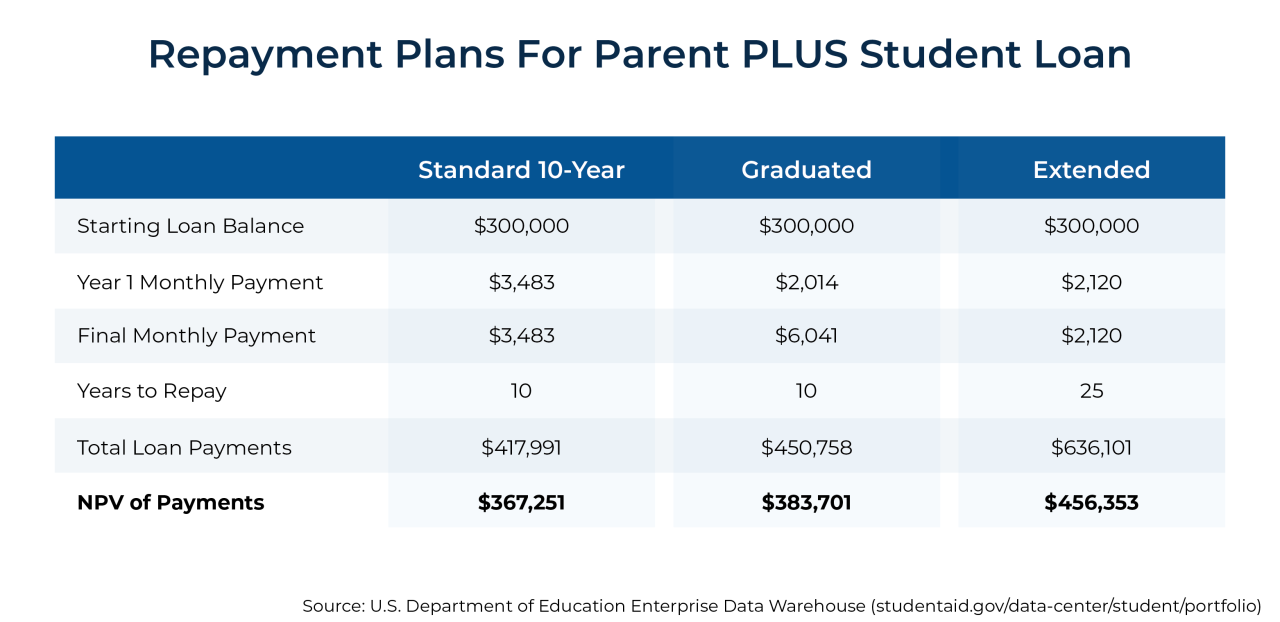

For federal student loans, the typical repayment period is 10 years. If a 10-year repayment period makes your monthly payments unaffordable, you can opt for an Income Driven Repayment (IDR) plan.

How To File For Student Loan Bankruptcy

Annuity-based plans spread payments over 20 or 25 years. After that time, assuming you’ve made all the appropriate payments, any loan balance is forgiven. Historically, payments have been based on your family income and family size and will typically be around 10%, 15% or 20% of your gross income, depending on the plan.

Below are the four types of IDR programs offered by the U.S. Department of Education, along with the payment periods and monthly payments for each:

An IDR plan can be a good choice for people in low-paying jobs with large amounts of student loan debt. Eligibility varies between programs, some federal loans are not eligible for repayment under all programs except one plan. In addition, you will need to reconfirm your income and family size each year, even if nothing has changed from year to year.

In August 2023, the Biden administration replaced the Pay As You Earn (REPAYE) program with the Savings in Valuable Education (SAVE) program. The plan promised to lower monthly payments, curb interest charges and make it easier to qualify for forgiveness.

Student Loan Refinancing

On July 18, 2024, a federal appeals court blocked the SAVE program until two court cases centered on the IDR program are resolved. The Department of Education has placed borrowers enrolled in the SAVE program in interest-free forbearance while the case is pending. He also explained the options for borrowers approaching Public Service Loan (PSLF) forgiveness—borrowers can “buy out” months of PSLF loans if they reach 120 months of payments while in forbearance or switch to another IDR program.

To apply for an IDR, you must submit an Income-Based Repayment Program Application, which can be completed online or on paper, and the latter must be requested from your loan servicer. You can choose a specific IDR plan by name or ask the borrower to enroll you in an income-focused plan that qualifies for a lower monthly payment.

If any of the loans you wish to include in the IDR program have different loan officers, you will need to submit a separate application to each of them.

To determine your eligibility for certain programs and calculate your monthly payment, you will need to provide documentation of your adjusted gross income (AGI) or other income. If you’ve filed a federal income tax return within the past two years and your current income is very similar to what you reported on your last return, you’ll use your AGI. If you cannot meet any of these criteria, additional income documentation will be required.

The Pros And Cons Of Refinancing Student Loans I Earnest

Student Loan Forgiveness Teachers can approve up to $17,500 in forgiveness for Federal Direct and Stafford student loans (but not Undergraduate Student Loans (PLUS) or Perkins Loans). Teachers must have taught for five full and consecutive years and have taught in a low-income school or educational service agency.

Even if you were unable to complete a full year of teaching, it can still count for five years of study if:

Qualified teachers must have at least a bachelor’s degree and full state certification and have not received their certification or licensure requirements in an emergency, part-time or part-time setting, with additional qualifications that vary depending on whether they are new to the profession or not.

Only full-time science and math teachers at the secondary level and special education teachers at the elementary or secondary level are eligible for the $17,500 waiver. The exemption is limited to $5,000 for some full-time elementary or secondary teachers.

Medical Resident Refinance

If you had an outstanding balance on a Direct Loan or FFEL on October 1, 1998, or have had since then, then you will not be eligible for the program. Additionally, only loans made before the end of five academic years of qualified teaching service will be eligible for teacher loan forgiveness.

You may be eligible for both the Teacher Loan Forgiveness and Public Service Loan Forgiveness (PSLF) programs, but you cannot use the same years of teaching to meet the eligibility requirements for both programs. So you’ll need 15 years of teaching to qualify for both programs and meet any specific requirements to qualify for each type of exemption.

Once you have completed your five full and consecutive years of professional teaching, you only need to submit a completed Teacher Loan Forgiveness application to your loan servicer to apply for the Teacher Loan Forgiveness Program.

If any of the loans you want forgiven under the Teacher Loan Forgiveness program have different borrowers, you will need to submit a separate form for all of them.

Should I Refinance My Federal Student Loans?

The certificate part of the application will need to be completed by the chief administrative officer of the school or education service agency where you did your relevant teaching service, which means you will need to send the form to them before submitting it.

If you are employed full-time by the U.S. federal, state, local, or national government, or a nonprofit organization, you may be eligible for student loan forgiveness. To qualify, you will need to make 120 payments, not consecutively, under an eligible payment plan.

This option is not for fresh graduates as you need at least 10 years to qualify. In addition, you will need to have a direct federal loan or consolidate a federal loan into a direct loan.

Unfortunately, the show was fraught with controversy. The US government established the PSLF program in 2007, and when the first borrowers became eligible for forgiveness in 2017, almost all of their applications were rejected, often for technical reasons. In some cases, borrowers have found that their loan officers misled them about their eligibility for the program.

How To Get Student Loan Forgiveness [full Program List]

Temporary Public Service Loan Forgiveness (TEPSLF) can help you if your application for Public Service Loan Forgiveness (PSLF) was previously denied.

On October 6, 2021, the Department of Education announced temporary changes to the PSLF program that allowed borrowers to receive credit for past due payments regardless of the payment plan or loan plan and regardless of whether payments were made on time or in full.

Many of the previous PSLF requirements have been dropped as part of the change, but two key requirements remain:

The waiver also allowed active duty members to count deferrals and discounts from the PSLF. The last major change included in this update is that the US government reviewed rejected PSLF applications for potential errors and allowed borrowers to review their PSLF decision. The PSLF limited waiver option expires on October 31, 2022.

Debt Consolidation Loan: Consolidating Credit Card Loans

Applying for PSLF involves four steps, each of which requires the use of the online PSLF Help Tool:

For the final step, send the completed form and your employer’s certificate to MOHELI, the US Department of Education’s federal loan servicer for the PSLF program. If MOHELA is already processing your loan, you can upload your PSLF form directly on their website. Or, you can fax or mail the form to the address listed on the US Department of Education website.

Closed School Discharge is a federal student loan forgiveness program for borrowers whose schools close during enrollment or within 180 days of discharge, or 120 days if the loan