Discover Student Loans Refinance: Save More On Your Education Debt – To continue using all features of Navy Federal Online, please use a web browser. Confirm your internet access.

High monthly student loan payments can get in the way of other goals, such as buying a home or car, saving for retirement, or preparing for financial emergencies. If you refinance your student loans, you can lower your monthly payments and use the savings to meet your other goals!

Discover Student Loans Refinance: Save More On Your Education Debt

Student loans can help you save money, make payments easier, and reduce financial stress. Find smart ways to pay back the money you saved by paying off your student loans so you can get on the road to financial freedom.

How To Get A Student Loan Without Your Parents

Refinancing your student loans can lower your monthly payments and give you extra money for an important part of your life. Here are 7 smart ways you can use those savings to improve your financial situation.

Use your savings to pay off your mortgage faster, help you build equity, and lower your interest costs.

Pay more payments to pay off your car loan sooner, eliminate your monthly payment and free up money for other purposes.

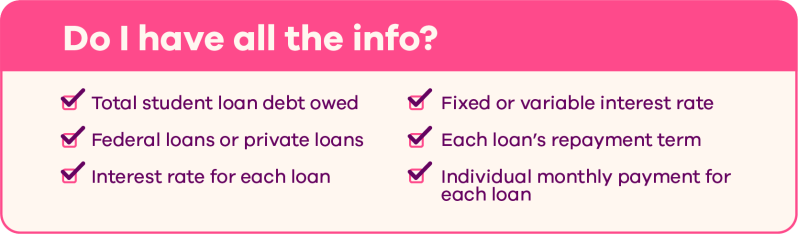

Ready to find out if you can reduce your student loan debt so you can put more money toward your goals? There are only a few steps to paying off your student loans.

2024 Student Loan Limits For Undergraduates And Graduates

Refinancing your student loans can open up new financial opportunities by freeing up extra cash each month. Refinancing involves getting a new loan with better terms, such as a lower down payment and lower monthly payments.

Here are 7 tips on how to transform those savings into milestones and financial stability.

It may seem like a long time to own a home, but it’s never too early to start saving early. Start by setting a goal and creating a savings account for your future home.

Paying off part of your student loan balance can help you reach your goal faster. A significant down payment can lower your monthly mortgage payment and reduce the total amount paid over the life of the loan.

How Does Cosigning A Student Loan Affect My Credit? Earnest Blog

If you own a home, consider using the money you save from paying off your student loans to pay off your mortgage. Additional payments can lower your mortgage principal balance, helping you pay off the loan faster and save you interest. Small down payments can significantly lower the cost of your mortgage and help build home equity faster.

Emergency funds are important for financial stability, and money saved from student loan debt can help you start or grow yours. Try to save at least 3-6 months of living expenses. Having an emergency fund will protect you from unexpected financial shocks and prevent you from taking on too much debt when times are tough.

Investing in your retirement is one of the best uses for extra cash. In addition to paying off student loan debt, consider increasing your contributions to retirement savings accounts such as a 401(k) or IRA. Higher contributions can benefit from compound interest, which can help your retirement savings grow better.

If your employer offers a matching allowance, consider increasing it to save as much as possible for your retirement.

Best Student Loans And Rates In 2024

High-interest debt, like credit card balances, can be a huge financial burden. Using the extra money from your student loan repayments to pay off these debts can help take that burden off you.

Pay off the loan with the highest interest rate first to save the most on interest payments. Lowering your credit score can help improve your credit score, paving the way for better credit in the future.

Big life milestones – weddings, honeymoons, starting a family – often involve big expenses. Savings from paying off student loans can help you prepare financially for these events.

Create a savings plan for each stage and stick to it. Advance planning and care can make these important life events easier (and less stressful).

How To Refinance Your Student Loan: 5 Steps

Consider using your student loan money to make extra payments on your car loan. Paying off your car loan early can lower your interest payments and free up money in your budget. Even better: making your regular car loan payments gives you more flexibility each month.

Student loans can be repaid if you have a low down payment or good credit. It can lower your monthly payments and the amount of interest you pay over the life of the loan, helping you pay off your student loans faster. It can simplify your payment process by consolidating multiple loans into one.

Refinancing can save you money by lowering your interest rate, which will lower the interest you pay over the life of the loan. It can extend your repayment term, lower your monthly payment and increase the amount of interest you pay over time.

To estimate your budget, you can use a student loan calculator that provides a detailed estimate of how you can lower interest rates and save money over time.

7 Smart Ways To Use The Money You May Save When Refinancing Student Loans

Lenders need a good to excellent credit score to be able to get the best mortgage rates and terms. Generally, a credit score of 650 or higher is best, but a higher score can secure better rates. Some lenders also offer loans to borrowers who have low credit scores but can afford to pay high interest rates.

If you have no credit history or a low credit score, adding a cosigner with good credit to your student loan application can help you get approved for a loan. You may be able to secure a better loan term or interest rate when approaching a lender.

Yes, you can refinance federal and private student loans. However, refinancing federal loans with a private lender means losing benefits and protections. Before refinancing federal student loans, consider the pros and cons of refinancing, as well as your financial situation and long-term goals.

The funding process usually takes several weeks from application to approval. This process may vary depending on the provider and your response to providing the required documents. Once approved, your new lender will pay off your current loans and you will begin making payments to your new lender.

Student Loan Forgiveness Updates And Faqs: Who Qualifies And How To Apply

Did you know that 9 out of 10 of our student loan borrowers are co-signers? If you have bad credit, getting a good and affordable cosigner can help improve your chances of getting approved for a student loan with a low interest rate.

This information is intended to provide general information and should not be construed as legal, tax or financial advice. It is a good idea to consult a tax or financial advisor for specific information about how certain laws apply to your situation and financial situation.

Navy Federal does not endorse and is not responsible for the product, service, overall web content, security, or privacy policies of third-party websites. Navy Federal Credit Union is not responsible for the privacy and security policies of affiliate websites. Please see the site policy for more information. Editor’s Note: Lantern by SoFi strives to provide relevant, independent and accurate content. Authors are separate from our business and do not receive direct payment from advertisers or partners. Read more about our editorial guidelines and how we make money.

You may be wondering how to refinance your student loans, save on interest, or increase your salary. Basically, you can refinance your student loans in just five easy steps. If you refinance your federal student loan, you will no longer have access to certain benefits and payment options offered by the federal government. Take advantage of low interest rates and terms that lower your overall borrowing costs. Borrowers with bad credit and low debt ratios can get a better rate from the lender. However, this means that you may owe the entire interest on the loan. Evaluating the pros and cons of student loan debt can help you decide if additional financing is right for you. Refinancing to a lower rate and shorter payback period can lower your total cost. But federal student loan repayment is not eligible for you if you qualify for Public Service Loan Forgiveness (PSLF) or the $0 monthly payment under the IDR plan. , Principal Loan Forgiveness or Recovery in Economic Education (SAVE) program. How do you get a student loan to pay off your student loans? Those currently enrolled will remain at zero percent until the case goes to court. We will update this page as more information becomes available

Lenders That Refinance Student Loans With No Degree

Discover debt consolidation loans, discover student loans refinance, loans to refinance debt, refinance your student loans, student debt refinance, student loans refinance, debt refinance loans, discover education loans, discover student loan refinance, student loans debt, save on student loans, discover loans student loans