Discover Student Loan Refinance: Is It Right For You? – Is always editorially independent. While we maintain editorial integrity, this post may contain links to products from our partners. Here is an explanation of how we make money. Our promise is that everything we publish is objective, accurate and reliable.

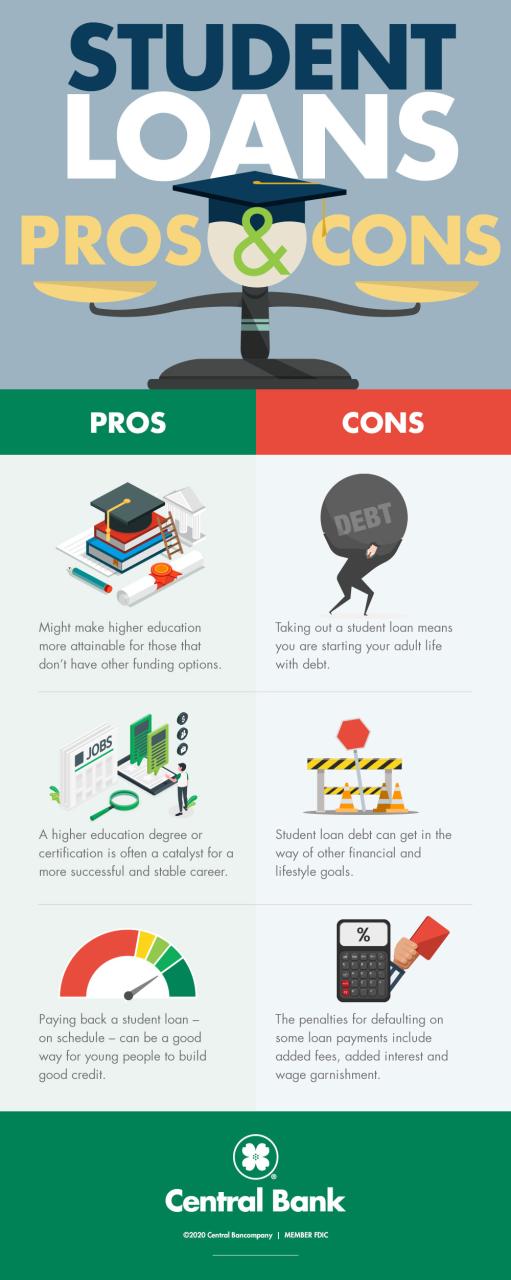

Student loan refinancing involves taking one or more existing student loans and transferring them to a new private loan – usually to lower your interest rate or streamline payments.

Discover Student Loan Refinance: Is It Right For You?

When you secure a low interest rate refinance, your monthly payments can become more manageable and potentially save you thousands of dollars over the life of the loan.

Planning For Early Student Loan Payoff

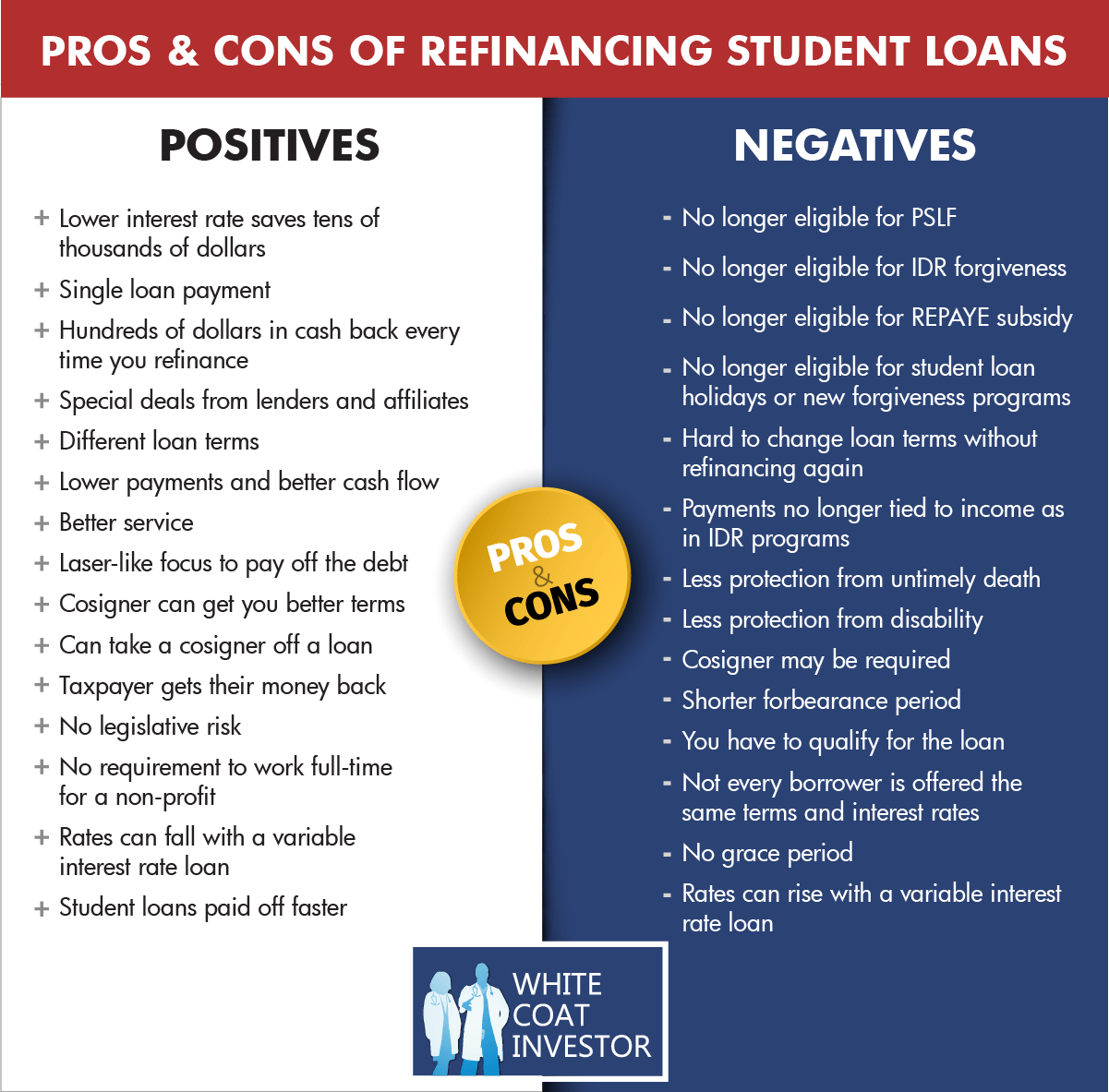

However, refinancing is not for everyone. Before you refinance your loan, you should be aware of the factors involved to ensure that it will be profitable.

When considering refinancing your student loans, consider your finances, existing loan benefits, and any potential savings. Refinancing can make sense in the following scenarios.

Refinancing is great if you can save money and time, but it’s not always the right move for everyone. In these cases, you should avoid refinancing.

There is no set eligibility standard that all lenders use for refinancing. To see if you qualify for a refinance, first check with different lenders and consider the following:

Discover It® Student Cash Back Card

Refinancing your student loans can save you a few dollars a month or hundreds of dollars a year. How much you save depends on what you pay now and what you can pay when you refinance.

For example, say you have a $20,000 balance with an interest rate of 5 percent and a five-year repayment period. In this scenario, you would have a monthly payment of $377.42. If you refinance a new loan with the same term but an interest rate of 4 percent, your monthly payment will be $368.33. That’s a monthly savings of $9.09 per month, but a total savings of $545.65 over the life of the loan.

And that’s just a fraction of a percentage point; if you can get a much lower rate, you can save thousands of dollars. Use our student loan refinance calculator to find out how much you can save.

If refinancing isn’t the right move for you at this time, there are other alternatives you may want to consider, including:

College Student Credit Cards

Remember, it’s important to carefully evaluate your financial situation and loan conditions before deciding on the best strategy for managing your student loans.

Refinancing your student loans can be a smart financial move if it results in significant savings. However, it is important to assess your individual circumstances and suitability before making a decision. With the current uncertainty surrounding federal loans and interest rates, it is important to carefully consider all options and alternatives before committing to a refinance. By taking the time to carefully evaluate your options, you can make the best decision to manage your student loans and achieve financial stability.

Dori Zinn has been a personal finance journalist for over ten years. In addition to his work for , his columns have appeared on CNET, Yahoo Finance, MSN Money, Wirecutter, Quartz, Inc. and so on. He loves to educate people about money, specializing in investments, real estate, lending money and financial literacy. is always editorially independent. While we maintain editorial integrity, this post may contain links to products from our partners. Here is an explanation of how we make money. Our promise is that everything we publish is objective, accurate and reliable.

Student loan refinancing is when you apply for a new loan to pay off your current student loans. Refinancing student loans can be difficult, but it can also offer significant benefits to borrowers. With the potential to lower interest rates and save you money in the long run, refinancing can be an attractive option.

Is The Discover It Student Cash Back Worth It?

However, it is important to understand the process and potential risks before making a decision. From the risks of refinancing federal student loans to how to find the best refinancing loans, here’s what you need to know.

It is important to understand how student loan refinancing works before deciding to make such an important financial decision. When you decide to refinance your student loans, you must choose which loans you want to refinance.

Refinancing is only available through private lenders, which is an important consideration when determining which loans to refinance. When you refinance federal student loans, you lose protections such as special repayment plans and possible loan forgiveness.

You want to find lenders that offer the lowest interest rates and the most favorable loan terms for your needs.

Best Student Loan Refinance Companies Of October 2024

Also consider the payment plans available from each lender. Some offer an option, while others allow you to adjust your payment plan to fit your budget. Keep hardship options in mind if you have financial difficulties in the future.

Many lenders offer a pre-qualification where you enter basic information about yourself and your existing loans in exchange for a quote. Unlike a formal application, a pre-qualification will not hurt your credit score. This is the best way to compare rates between lenders. It is said that you should apply officially after choosing a lender who needs a solid loan.

If you have bad credit or low income, you may not be approved to refinance your student loans. You may be able to match a co-signer with a better credit history.

Once the loan is approved, the loan funds will be used to pay off your existing student loans. From there, you start paying the new refinanced loan. With a lower interest rate or shorter payment period, you will pay less over time on your refinanced loan than you did on your previous loans.

Supreme Court Ruling On Student Loans: What To Do About It

With the question, “What is student loan financing?”, another important factor to consider is the eligibility requirement. There is no minimum standard for refinancing; Each institution determines what is a suitable loan for itself.

When looking for a student loan refinancing loan, consider how you rank in each of these qualifying categories:

Borrowers with high interest rates on private loans are the best candidates for refinancing because they have the opportunity to save more money. But even without a better rate, refinancing for a shorter term can save you money. However, you will have a higher monthly payment.

For example, say you owe $50,000 with an interest rate of 12 percent and a term of 10 years. The table shows how your savings would break down if you refinance to a 6 percent rate or keep the same rate but refinance for a shorter term.

Healthcare Banking For Doctors

Refinancing is not the best option for everyone. Borrowers with federal student loans in particular should think carefully about default.

Refinancing federal student loans removes many of their benefits. For example, you will no longer be able to get debt forgiveness through programs like income payment plans or public service forgiveness.

Student loan financing can affect your credit score for the worse or better, depending on your financial situation.

If you manage your money properly, refinancing can improve your credit. This is especially true if refinancing helps you make your monthly payments. These factors have a positive impact on your credit score:

Introduction To Lendkey Student Loans

There are several situations where refinancing can hurt your credit score. However, in most cases the effect is temporary and relatively small. Here’s what can lower your credit score:

Now that you know what student loan refinancing means, it’s important to remember when it can be a positive move. Student loan refinancing can help some borrowers save money by replacing their existing loans with a new private loan at a lower rate.

That said, it’s not the right choice for everyone. If you have federal student loans, consider that refinancing means giving up benefits like federal forgiveness and student loan forgiveness programs.

If you’re sure a refinance is right for you, compare rates, terms and fees from as many lenders as possible.

Student Loan Interest Rates: Everything You Need To Know

Chicago: Taylor, Mia. “What is student loan financing and how does it work?” . 15 Aug 2024. https:///loans/student-loans/what-is-student-loan-refinancing/.

Mia Taylor is an award-winning contributor and journalist with two decades of experience and has worked as a reporter or contributor for some of the nation’s leading newspapers and websites, including The Atlanta Journal-Constitution, San Diego Union-Tribune, TheStreet. , MSN and Credit.com.

Discover student loan refinance, discover refinance home loan, discover loan refinance, discover refinance auto loan, discover personal loan refinance, discover it student loan, discover loan student, student loan refinance loan, discover student loan refinance rates, discover student loans refinance, discover card student loan refinance, discover refinance car loan