Discover Card Student Loan Refinance: Simplify Your Payments Today – Your credit report is a snapshot of your credit history. The information contained in your credit report is used to determine your credit score.

Lenders use this information to help them decide whether to give you a loan. If they decide to lend you money, these details may include your loan amount and interest rate.

Discover Card Student Loan Refinance: Simplify Your Payments Today

For this reason, it is a good idea to review the information on your credit report annually. This allows you to track potential errors and identify potential identity theft. A complete understanding of your credit report can help you both protect and improve your financial health.

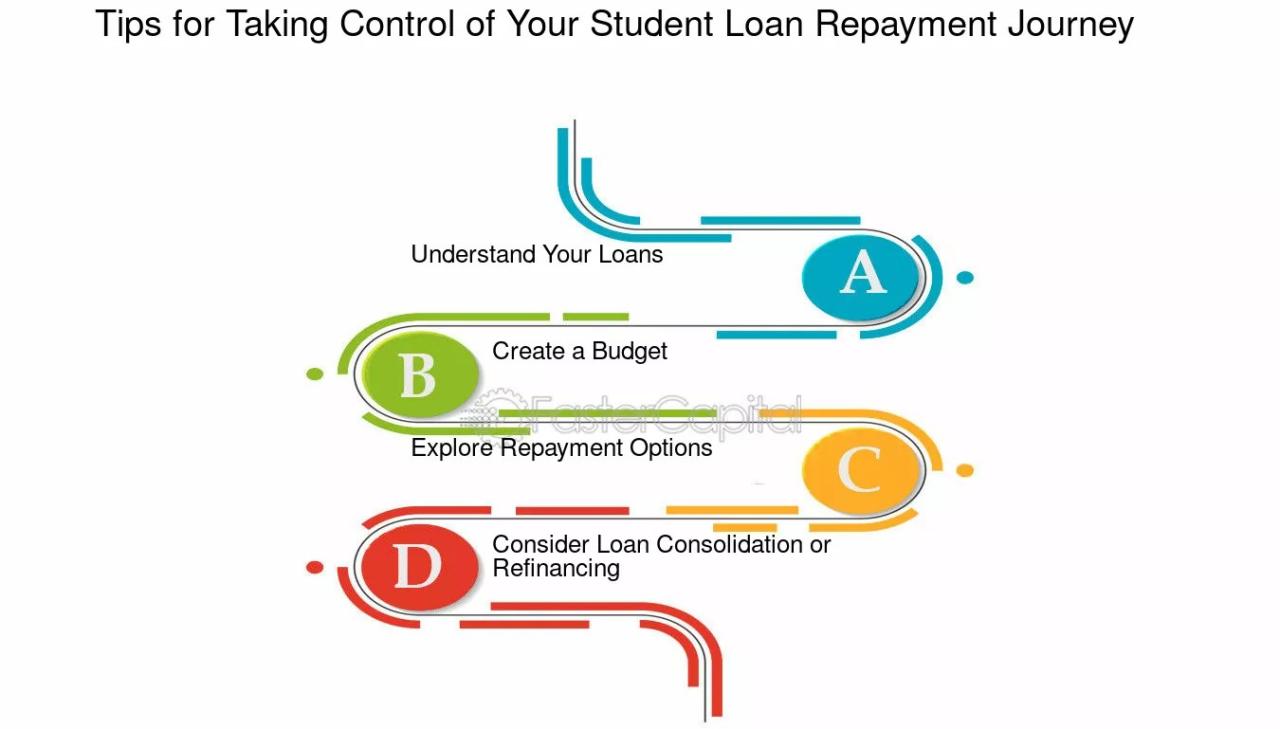

Student Loan Refinancing Vs. Consolidation

There are three credit reporting agencies, also called credit bureaus or consumer reporting agencies: TransUnion®, Equifax®, and Experian®. You can request a free copy of all three of your credit reports each year at dailycreditreport.com. You can also check your credit report from any credit bureau once a week for free. Checking your credit report does not affect your credit score.

A credit report is a record of your credit activity. It shows things like the status of your accounts and the history of your loan payments.

Information on your credit report is collected from various lenders, including credit card companies and other financial companies. Creditors are not required to report your activity to any credit reporting agency, so it is recommended that you check all three reports.

Looking at your credit report for the first time can be confusing. But it shouldn’t be. We’ve broken it down to help you make sense of it all.

Credit Card Refinancing Vs Consolidation

Although all three credit reporting agencies may present your information differently, your credit report covers five important areas:

Each category contains information that you should consider. Look for what you don’t understand or what is wrong. If you have questions or disputes, contact the credit reporting agency. This can be done for free and without affecting your credit score.

The first section of your credit report shows your personal information. Although the information listed does not affect your credit score, you should check that all details are accurate and complete. Incorrect information could be a sign that you are a victim of identity theft or that something has gone wrong.

If you see any errors, contact the credit bureau to update the information. Lenders use this information to adjust your credit report for each new application and may rely on it to send you notifications.

12 Best Debt Consolidation Loans Of October 2024

Your credit report details the companies that have given you credit. This includes your current debts and any debts or accounts you may have had in the past. Some lenders do not provide information to all three credit reporting agencies. This is one reason why it is important to check your credit report from each of these three.

You want to make sure that you identify each account and that the information is correct. Negative information, such as late payments on a loan or credit card, can be the result of a mistake or the result of fraud. This type of information can remain in your report for up to seven years. Previous accounts with proper management should remain on your account for 10 years.

Your payment history may also record late payments. Creditors usually report late payments within 30 days:

If the loan amount is considered non-performing by the lender, this will also be recorded on your credit report. The payment may be sent to a collection agency.

What Are Unexpected Expenses And How To Avoid Them

Any of the following categories can have a negative impact on your credit score. The later the payment, the more it can hurt your credit score. For this reason, it’s important to stay on top of your payments or make payments that don’t fall into the delinquent category on your account within the next 30 days.

Credit inquiries, also known as credit checks, occur when a company or individual has a legal reason to review your credit report. Only so-called “hard” inquiries are shown to potential lenders, although you may see “soft” inquiries when you check your credit report. Too many hard inquiries in a short period of time can be a red flag to potential lenders that you are seeking too many loans.

This area of your credit report refers to public records that may affect your credit rating. Until recently this could include bankruptcies, tax liens and civil judgments. However, bankruptcy is currently the only public record listed by reporting agencies. Other records are available elsewhere.

Since filing for bankruptcy can make it harder and more expensive to get new loans, it’s important to check these items and make sure they are correct. Remember that any bankruptcy filing must be removed from your report after seven to 10 years.

Student Loans & Student Loan Refinancing

A collection is an account that has been paid off and transferred to a collection agency or sold by a creditor to a collection agency or private collector. When this happens, the account is listed in this section of your credit report.

As with any other information in your report, you want to make sure these items are accurate. Remember that a late payment or delinquent bill can negatively affect your credit score. This can make it harder or more expensive to get a loan. These items can remain on your credit history for up to seven years after you default.

While most of your credit history is included on your credit report, there are important areas of your personal and financial life that are not. These include your income, your investments, your bank account balance, any medical information, criminal record, education level, marital status or your race, religion, ethnicity, political affiliation or disability.

Your credit report may also include an explanation of your rights under the federal Fair Credit Reporting Act and elsewhere. This is usually included at the end of the report. Knowing your rights will help you know what protections you have as a consumer.

Simplify Your Student Loan Search

While it’s important to review your credit report for accurate information, be aware that some details will only stay on your report for a few years, as determined by laws and regulations.

Hard inquiries stay on your credit report for two years, but only those from the past 12 months affect your credit score. Closed accounts with a history of on-time payments can remain for up to 10 years, while accounts with a negative history can only remain for up to seven years.

It is important to ensure that all information is updated and complies with the latest consumer protection laws.

You also have the right to add certain statements to your credit report. These may include identity theft, service member alerts, or alerts to freeze any credit activity.

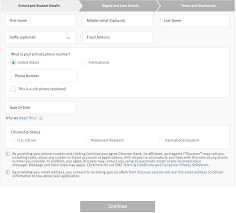

Discover Student Loans Refinance

No, credit reports and credit scores are not the same. Your credit score is not included in your credit report. Scores are calculated by individual companies using information from your credit report.

Your financial life depends on your credit score; Your score is based on your credit reporting history. That’s why it’s important to understand what your credit report contains and what it means.

It is recommended that you check your credit report at least once a year as an important step in protecting your financial health. The Financial Protection Bureau even offers a financial checklist to help you check your credit report. With a detailed list of your credit accounts and balances, you can better manage your debts, create an effective budget, and save money on interest.

As a ® customer, you can also get a free credit card with your FICO® credit score and important data behind it, such as credit utilization, number of missed payments, number of recent applications, length of credit history and total number of accounts. *

Paying Less Than The Minimum On Credit Cards

In addition to being an important tool for lenders, your credit report cell also gives you insight into your financial health.

When you check your credit report, for example, you may come across bills you forgot or late payments you didn’t know about. You can also view the latest balances on your existing accounts. This can help you decide whether or not you should take steps to simplify your finances and save money.

A major step may be to consolidate multiple accounts for a personal loan. Personal loans can be used to consolidate credit card debts. Consolidating several higher-interest-rate balances into one loan with one monthly payment can save you interest.

Articles may contain information from third parties. Inclusion of such information does not imply affiliation with the Bank or sponsorship, endorsement or approval of any third party or information.

How To Pay Off Student Loans Fast

The information contained herein is for informational purposes only and is not intended to be construed as professional advice. Nothing contained in this section shall create or be construed as inducing any obligation or liability on the part of the bank or its affiliates.

And may differ from other credit inquiries and other credit information provided by different bureaus. This information is intended and provided only

Student loan refinance loan, discover card student loan, discover student loan refinance, discover refinance home loan, discover loan student, discover card student loan refinance, discover student loan refinance rates, discover student loans refinance, discover loan refinance, discover personal loan refinance, refinance your student loan, student loan payments