Difference between life insurance and ad&d – The topic of life insurance versus AD&D insurance can be complex, but this guide aims to provide a clear and comprehensive overview of the key differences between these two important financial protection options.

Life insurance and AD&D insurance both provide financial protection in the event of an unexpected event, but they differ in their specific coverage, benefits, and suitability for different individuals and families.

Definition of Life Insurance

Life insurance is a financial product that provides financial protection to the beneficiaries of the insured person in the event of their death. It is a contract between an insurance company and the policyholder, where the insurance company agrees to pay a sum of money to the beneficiaries upon the policyholder’s death in exchange for regular premium payments.

The primary purpose of life insurance is to provide financial security to loved ones who depend on the income or support of the insured person. It can help cover expenses such as funeral costs, outstanding debts, mortgage payments, and living expenses, ensuring that the family can maintain their standard of living and avoid financial hardship in the event of the insured person’s untimely demise.

Unlike life insurance, which is designed to provide financial protection for beneficiaries in the event of the policyholder’s death, AD&D insurance specifically covers accidental deaths and dismemberment. Voluntary life insurance, on the other hand, is an optional coverage offered by employers or organizations that provides additional life insurance protection beyond the basic coverage provided by the employer or organization.

While both life insurance and voluntary life insurance offer financial protection in the event of death, they differ in terms of their coverage and the circumstances under which they provide benefits.

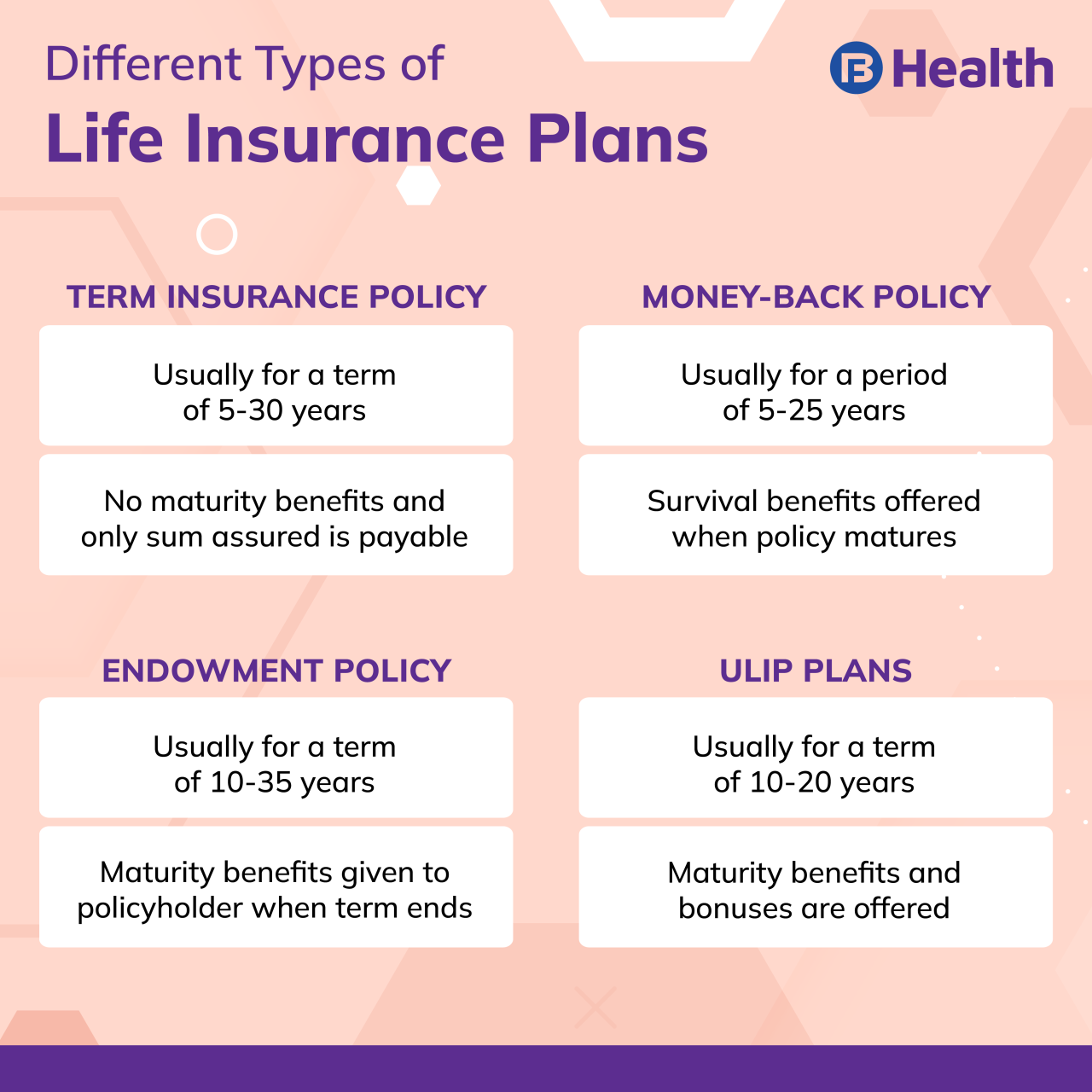

Types of Life Insurance Policies, Difference between life insurance and ad&d

There are various types of life insurance policies available, each tailored to specific needs and circumstances. Some common types include:

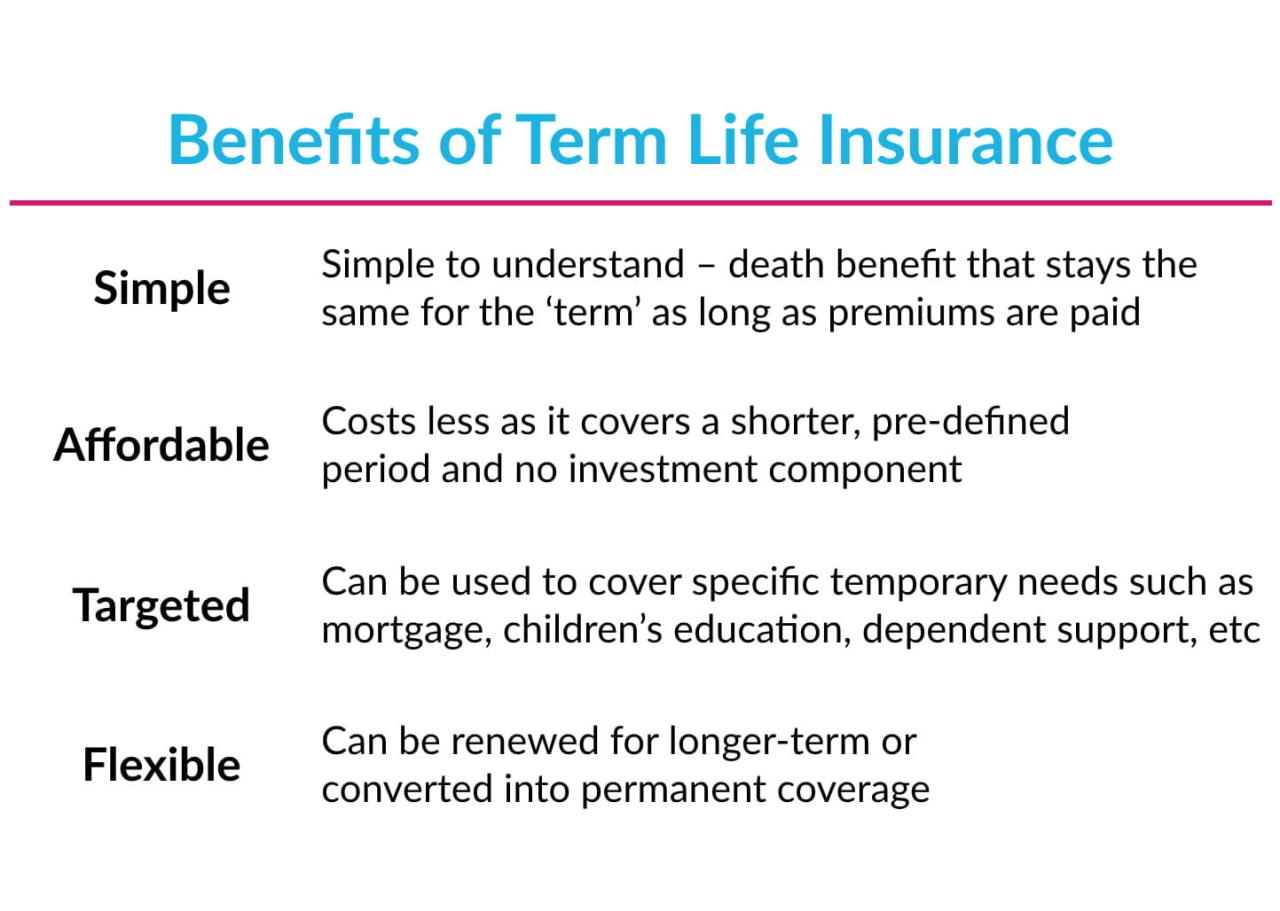

- Term Life Insurance: Provides coverage for a specified period, such as 10, 20, or 30 years. It is typically the most affordable type of life insurance.

- Whole Life Insurance: Provides lifelong coverage and also has a cash value component that grows over time. The cash value can be borrowed against or withdrawn, providing additional financial flexibility.

- Universal Life Insurance: Similar to whole life insurance, but offers more flexibility in terms of premium payments and death benefit. The cash value component also grows tax-deferred.

- Variable Life Insurance: A type of whole life insurance where the cash value is invested in a sub-account, which can fluctuate in value based on market performance.

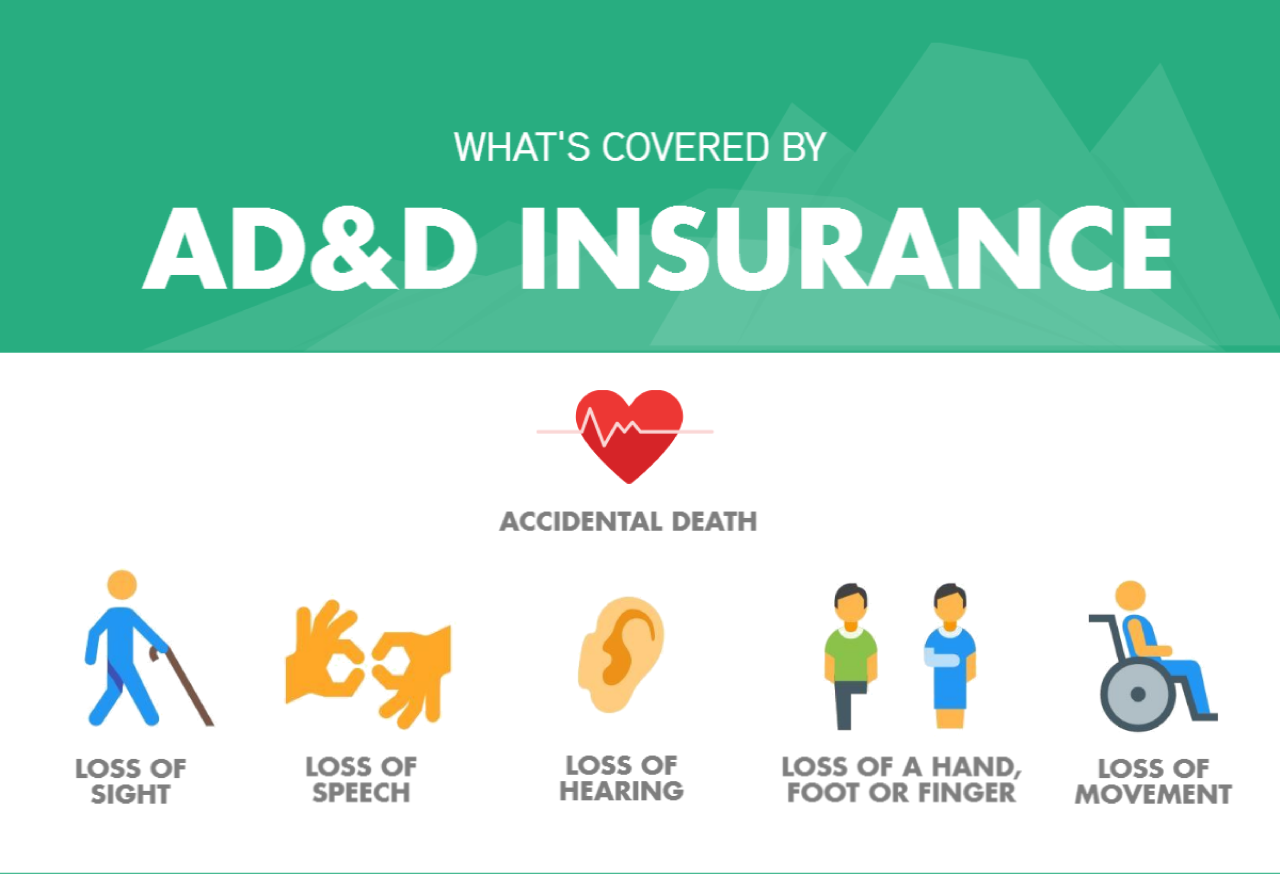

Definition of AD&D Insurance

AD&D insurance, or Accidental Death and Dismemberment insurance, is a type of insurance policy that provides financial protection in the event of an accidental death or dismemberment. It is designed to cover expenses related to the accident, such as medical bills, funeral costs, and lost income.

AD&D insurance policies typically provide coverage for a variety of accidents, including:

- Car accidents

- Pedestrian accidents

- Slip and fall accidents

- Drowning

- Acts of violence

Comparison of Coverage

Life insurance and AD&D insurance provide different types of coverage. Life insurance provides a death benefit to the beneficiary in the event of the insured’s death. AD&D insurance provides a dismemberment benefit if the insured loses a limb or suffers a disabling injury.

While life insurance provides financial protection in the event of death, AD&D insurance specifically covers accidental death and dismemberment. AD&D insurance is designed to provide financial assistance in case of an accidental loss of life, limb, or eyesight. Unlike life insurance, AD&D insurance does not cover death from natural causes or illness.

Therefore, it’s important to understand the difference between these two types of insurance to ensure adequate financial protection in case of unforeseen events.

The following table compares the coverage provided by life insurance and AD&D insurance:

| Coverage | Life Insurance | AD&D Insurance |

|---|---|---|

| Death benefit | Yes | No |

| Dismemberment benefit | No | Yes |

| Other relevant coverage | May include coverage for funeral expenses, medical expenses, and lost wages | May include coverage for medical expenses, lost wages, and rehabilitation |

Exclusions and Limitations

Life insurance and AD&D insurance policies both have exclusions and limitations that restrict coverage in certain situations. Understanding these exclusions and limitations is essential for policyholders to ensure they have adequate coverage for their needs.

Life insurance and AD&D (Accidental Death and Dismemberment) policies are both important financial safety nets, but they serve different purposes. Life insurance provides a death benefit to your beneficiaries, while AD&D provides a benefit if you die or suffer a dismembering injury as a result of an accident.

If you’re looking for the best life insurance coverage, it’s important to compare top-rated life insurance policies from reputable insurers. However, it’s crucial to understand the distinction between life insurance and AD&D to make an informed decision about your coverage needs.

Common exclusions in life insurance policies include death resulting from:

- Suicide within the first two years of the policy

- Acts of war

- Illegal activities

- Travel to certain high-risk countries

- Certain hazardous occupations

Common limitations in life insurance policies include:

- Limits on the amount of coverage available

- Waiting periods before coverage takes effect

- Reductions in coverage as the policyholder ages

AD&D Insurance Exclusions and Limitations

AD&D insurance policies also have exclusions and limitations, but they are typically more specific to the types of accidents and injuries covered.

- Exclusions in AD&D insurance policies often include:

- Death or injury resulting from natural causes

- Death or injury resulting from illness

- Death or injury resulting from self-inflicted wounds

- Death or injury resulting from participation in certain high-risk activities

- Limitations in AD&D insurance policies may include:

- Limits on the amount of coverage available

- Waiting periods before coverage takes effect

- Exclusions for certain types of accidents or injuries

It’s important to note that exclusions and limitations can vary significantly between different insurance companies and policies. Policyholders should carefully review the policy language to understand the specific coverage provided and any exclusions or limitations that may apply.

Cost and Premiums

The cost of life insurance and AD&D insurance premiums is influenced by several factors. Understanding these factors can help you make informed decisions about your coverage and budget.

The factors that influence the cost of life insurance premiums include:

- Age: Younger individuals typically pay lower premiums than older individuals.

- Health: Individuals with good health are generally eligible for lower premiums than those with pre-existing conditions or high-risk lifestyles.

- Gender: Statistically, women tend to have longer life expectancies than men, leading to lower premiums for women.

- Amount of coverage: The higher the coverage amount, the higher the premiums.

- Type of policy: Term life insurance is generally less expensive than whole life insurance.

The factors that influence the cost of AD&D insurance premiums include:

- Occupation: Individuals in high-risk occupations, such as construction workers or police officers, may pay higher premiums.

- Hobbies and activities: Engaging in dangerous hobbies or activities, such as skydiving or rock climbing, can also lead to higher premiums.

- Amount of coverage: Similar to life insurance, the higher the coverage amount, the higher the premiums.

Typically, life insurance premiums are higher than AD&D insurance premiums because life insurance provides coverage for a broader range of events and has a longer coverage period.

Suitability and Target Audience: Difference Between Life Insurance And Ad&d

Life insurance and AD&D insurance serve different purposes and are suitable for individuals and families with varying needs and circumstances. Understanding the target audience for each type of insurance is crucial in making informed decisions.

Life insurance is primarily designed to provide financial protection to beneficiaries in the event of the policyholder’s death. It is suitable for individuals with dependents who rely on their income, such as spouses, children, or aging parents. Life insurance ensures that the beneficiaries have financial resources to maintain their standard of living, cover debts, and pay for expenses related to the policyholder’s passing.

Suitability of AD&D Insurance

AD&D insurance, on the other hand, is specifically designed to provide coverage for accidental death and dismemberment. It is suitable for individuals who engage in hazardous occupations or participate in high-risk activities. AD&D insurance can provide a lump sum payment to beneficiaries if the policyholder dies or suffers a covered dismemberment due to an accident.

Recommendations for Choosing the Right Insurance

When choosing between life insurance and AD&D insurance, it is important to consider the following factors:

- Needs and Circumstances: Determine the financial obligations and dependents that need to be protected in the event of the policyholder’s death or dismemberment.

- Occupation and Activities: Assess the level of risk associated with the policyholder’s occupation and lifestyle. AD&D insurance may be more appropriate for individuals with high-risk occupations or hobbies.

- Budget: Consider the cost of premiums and the financial impact of purchasing both life insurance and AD&D insurance. It is essential to find an insurance plan that fits within the policyholder’s financial constraints.

By carefully considering these factors, individuals and families can make informed decisions about the type of insurance that best suits their needs and provides the necessary financial protection.

Outcome Summary

Ultimately, the decision of whether to purchase life insurance, AD&D insurance, or both depends on your individual needs, circumstances, and financial goals. By understanding the key differences between these two insurance options, you can make informed decisions about how to best protect yourself and your loved ones financially.