Corebridge Life Insurance: Comprehensive Coverage Options – Corebridge Financial recently announced its highly-anticipated index-registered earnings, making it the largest dividend-paying company in any major sector.

During a recent investment event, CEO Kevin Hogan expressed high expectations for the new MarketLock Annuity. Corebridge’s subsidiary, American General Life Insurance Co., will issue the product.

Corebridge Life Insurance: Comprehensive Coverage Options

“We recognize how important it is for financial professionals to have one trusted annuity provider that can help meet the diverse retirement needs of all their clients,” said Bryan Pinsky, president of personal retirement at Corebridge Financial. “With MarketLock, Corebridge is expanding what is already one of the broadest and most comprehensive annuity platforms in the industry.”

Corebridge Direct (aig Life) Review: Strength, Stability, And Comprehensive Coverage

RILA is a long-term deferred insurance policy, which is designed to help people save for retirement. RILAs work by linking the performance of a contract to one or more stock market indices, and provide a level of protection against market downturns.

Corebridge employs a “lock-in strategy” that locks in and rates a price based on the current performance of the S&P 500 index on the day a determined growth target is reached. Once the income is locked in, customers are guaranteed a fixed interest rate until the next contract anniversary, at which point they can transfer the assets to any available option in the MarketLock strategy. The growth targets of the lock-in strategy are 30%, 40% or 50% with 3-year terms and 50%, 75% or 100% with 6-year terms.

Corebridge RILA comes with 20 different accounting options including a lock strategy, as well as popular credit methods such as unlock (provides earning potential up to the maximum percentage), leverage (can guarantee a standard performance level when performance index is 0). % or higher) and double direction (opportunity to generate positive returns in up and down markets).

Pinsky: “We have put together the best of the best of what we have seen in the market, what RILA’s strategic consultants like today, and with that, we are also bringing a very unique and powerful collection strategy to the market. It’s happening before the strategic deadline, so I’m very excited.

Corebridge Financial General Session

Pinsky: “Financial professionals already see Corebridge as a unique platform where they can tailor a different annuity offering to the unique needs of each of their clients. Adding RILA to their already extensive product portfolio will giving us the ability now to truly find solutions for all of our clients’ varying risk and scope of retirement needs.”

Pinsky: “We are available in all jurisdictions except New York, California and Oregon. And we hope to have these last three states in the near future.”

Pinsky: “Gen X will have a generally higher tolerance than a baby boomer, given the fact that most people in Gen X still have 5 to 15 years, maybe more, of Before they retire. So, Corebridge RILA can be a good opportunity for them to have an upside exposure, the potential growth of their retirement assets while providing an additional level of protection if the equity markets do not perform well. .”

Pinsky: “We’re very happy with the broad distribution that we have today in a variety of different companies, and we’re really taking advantage of that existing network. We’ve seen a lot of interest in these distribution companies, and the financial advisors in these companies, to enter the RILA space, we have made it possible for this product to be approved and available for a long time in these companies … We have a significant share of the RILA market available in these companies We will have more to come weeks and months to come

Corebridge Direct Life Insurance Review

© All contents copyright 2024 by Inc. All rights reserved No part of this article may be reproduced without written permission.

Senior editor John Hilton has covered business and other beats for more than 20 years in daily journalism. John can be contacted at [email protected] . Follow him on Twitter @INNJohnH. AIG Whole Life Insurance has officially become Corebridge Direct, but what does this mean for life insurance? We’ve got everything you need to know about Whole Life Insurance, including cost, free benefits and more.

If you’re not sure if AIG Whole Life Insurance is right for you, call one of our representatives at (866) 786-0725 or use our free quote tool to find the insurance that works for you.

Want to learn more about whole life insurance? We have the lowdown on everything you need to know so you can choose the right plan for you and your family.

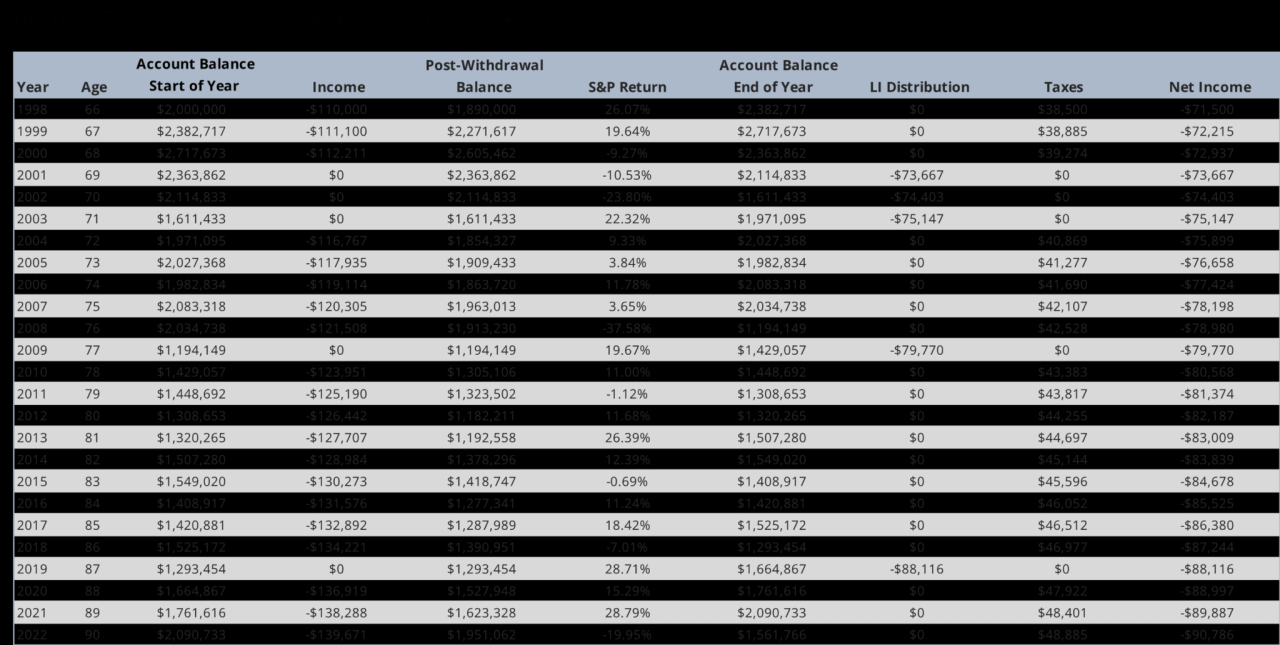

Are Annuities The Best Retirement Strategy For My Parents?

American International Group (AIG) was founded in 1919 by Cornelius Vander Starr in Shanghai, China. After the success, AIG expanded into the Americas, Europe and South America and now serves more than 70 countries and jurisdictions. They offer property damage insurance, life insurance, retirement solutions, and other financial services. Corebridge Financial is a division of AIG that was established in 2022 and focuses on life insurance policies and pensions. AIG Direct, AIG Guaranteed Whole Life Insurance Issue, has been renamed Corebridge Direct from 2024.

The guaranteed issue of Final Expense Insurance is Whole Life Insurance with no medical tests or medical questions. However, health status is not a factor in your price – gender, age and the amount of coverage you want will affect the cost.

However, because AIG Direct is guaranteed, there is a two-year waiting period before you can claim full assistance. This means that if it lapses before the end of two years, AIG will only refund 110% of the insurance cost instead of the full amount.

The only exception is if your death is accidental and not the fault of the policy owner. AIG will pay the full face value of the policy if this happens.

Corebridge Launches New Registered Index-linked Annuity Solution

Unfortunately, this plan is not available in ME or NY, so you will have to explore different final expense insurance options.

Unfortunately, if you don’t qualify for traditional life insurance because of a pre-existing condition or if you can’t pass a medical exam, you should consider guaranteed whole life insurance.

If you are unsure about the two-year waiting period or think you may qualify for guaranteed whole life insurance, there are funeral insurance options without a waiting period for you and your family. Contact one of our representatives at (866) 786-0725 for a complete list of funeral insurance companies that work for you.

The main difference between AIG Guaranteed Whole Life Insurance and other policies is the free Life Benefit Riders that come with the purchase of the policy. A Living Benefit Rider guarantees the payment of the policy for the life of the insured depending on the circumstances. This money can be used to pay hospital bills, pay off debts, or cover any other expenses.

Corebridge Hires Chris Smith To Replace Coo Mia Tarpey

Generally, the cost of Life Benefit Riders will depend on the cost of the policy or will charge you to get this benefit, but with AIG GIWL, you can get them if you have a permanent or terminal illness.

With AIG Guaranteed Whole Life Insurance, you have access to the Riders Life Benefit if you have symptoms of a chronic or terminal illness. Here’s how much you get from each and how to determine if you have chronic or terminal illness:

According to the CDC, a chronic disease is a chronic health condition that limits daily life. AIG will refund all premiums if the insured cannot perform two of the six functions:

You may also be eligible for a premium refund if you have been diagnosed with a cognitive impairment, such as dementia or Alzheimer’s.

Life Insurance Quoting Software

A chronic disease is a condition that cannot be cured and will most likely end in a person’s death. If the policyholder has received a terminal illness diagnosis and has a life expectancy of less than two years, Corebridge will allow the policyholder to access 50% of the death benefit.

The cost of AIG Guaranteed Whole Life Insurance will depend on your age, gender and how much you want to buy. This insurance is only available to those between the ages of 50 and 80 and ranges from $5,000 to $25,000.

* These figures are estimates. For a detailed quote, contact one of our representatives at (866) 786-0725.

AM Best is an agency that assesses the creditworthiness of an insurance company and how well it can meet its financial obligations based on its performance, governance, financial flexibility and more. AM employs a letter grade, similar to a school grading system, ranging from A+ to F. In 2024, AIG received an AM Best rating – the second highest rating in its category.

5 Best Universal Life Insurance Companies For 2024

NAIC, or the National Association of Insurance Agents, is a US-based regulatory advocacy organization designed to add credibility to insurance companies. Each year, they rate insurance companies a

State farm insurance comprehensive coverage, homeowners insurance coverage options, rv insurance coverage options, home insurance coverage options, comprehensive home insurance coverage, full coverage comprehensive insurance, comprehensive coverage for auto insurance, comprehensive liability insurance coverage, comprehensive coverage on car insurance, is comprehensive insurance full coverage, insurance coverage options, comprehensive and collision insurance coverage