Discover Bank Student Loan Refinance: Everything You Need To Know – The main idea behind this is usually to get a lower interest rate on student loans or adjust the term of the loan, whether your goal is faster debt repayment or smaller monthly payments.

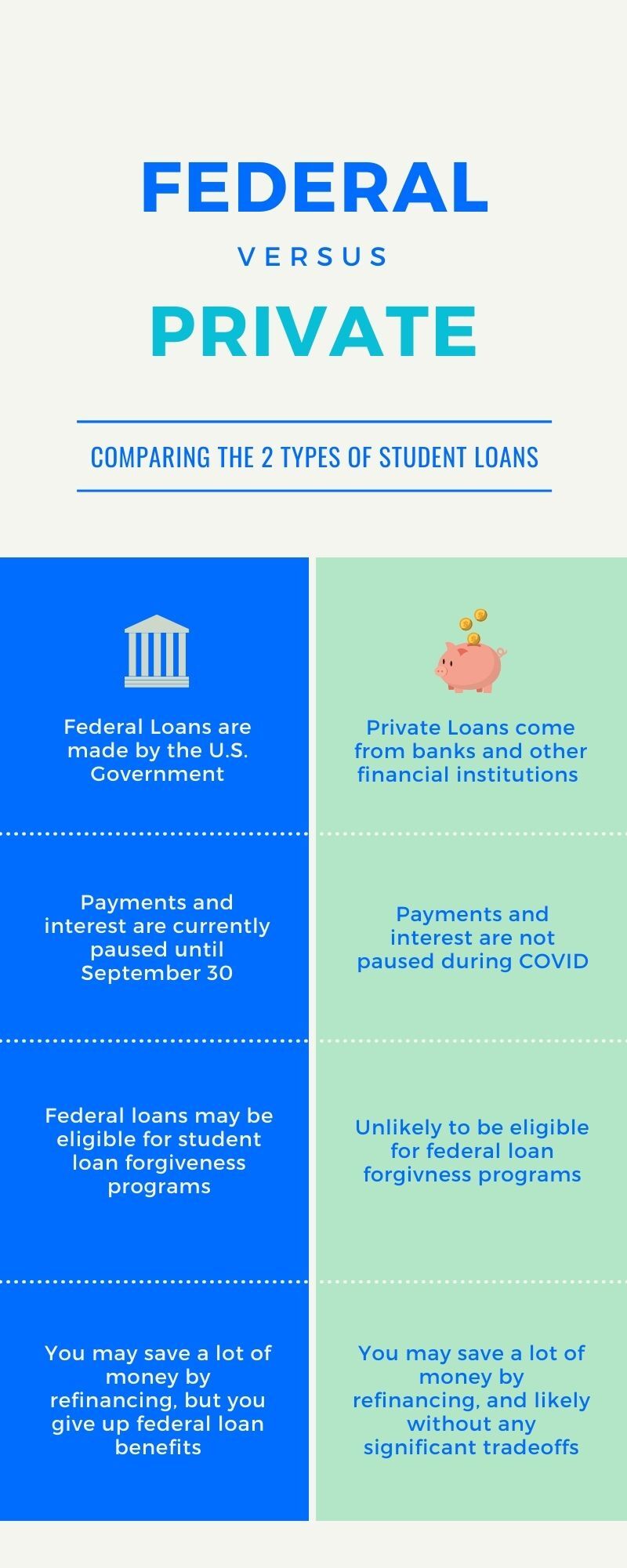

Unlike federal student loans, which come with certain borrower protections, private loans do not offer the same benefits. Some of these federal benefits include income-based repayment plans, loan forgiveness, and other federal protections.

Discover Bank Student Loan Refinance: Everything You Need To Know

Although refinancing federal student loans means giving up certain federal benefits, many borrowers find it beneficial to not rely on these programs or protections.

How To Refinance Your Student Loan: 5 Steps

However, refinancing a private loan does not have these drawbacks, making it a worthwhile strategy if you qualify for a better interest rate or more favorable terms.

Additionally, some private loans offer benefits such as hardship deferrals and forgiveness in the event of death or disability, helping borrowers who want additional financial protection.

Whether you want to refinance federal or private student loans, there are general eligibility criteria you must meet. These criteria help private lenders evaluate your creditworthiness and determine whether you qualify.

The first step in refinancing private student loans is to research and compare several lenders. Different lenders offer different benefits, so take your time and research various aspects, such as interest rates, loan terms, and borrower benefits.

Discover Wants To Leave The Student Loan Business

Some lenders offer fee discounts for setting up automatic payments or loyalty benefits if you are a longtime customer. Automatic payments also help you avoid late or late payments, which often come with hefty penalties.

Use online rate comparison tools to identify competitive rates and filter options based on your eligibility. By taking the time to shop around, you’ll have a better chance of finding a lender that fits your needs and financial goals.

Once you’ve identified a potential lender, the next step is to check to see if they offer prequalification. Many lenders provide prequalification tools, allowing you to get an approximate rate range without a difficult credit inquiry.

This is called a soft credit pull, which means it won’t affect your credit score, but it can give you an idea of the rates you might qualify for based on your credit profile.

Medical Residents Student Loan Refinance

Prequalifying can help you narrow down your options without having to fully apply, giving you a clearer picture of potential costs and requirements before proceeding.

It also gives you a chance to improve your credit history so you can get a better interest rate later if you don’t rush to refinance your student loans.

After selecting a lender, it’s time to complete the formal application. This involves a thorough credit investigation, which may temporarily affect your credit score by some point.

Lenders will review key financial factors, such as your income, employment history, and credit score, to evaluate your eligibility.

Discover Student Loans Review

Typically, they will ask for documents such as pay stubs, tax returns, and information about your current federal or private student loans.

This step determines whether you qualify and what specific rates and terms you are eligible for, and sets the stage for your refinancing.

Once your application is approved, you will have the opportunity to review and select your loan terms. Many lenders offer a variety of terms, so you can choose the option that best suits your financial situation.

Shorter terms result in higher monthly payments but reduce your overall interest, while longer terms lower your monthly payments but can increase total costs over time.

Consolidation Or Refinancing Student Loans: Which Is Right For You?

If you’re risk-averse or need budget stability, fixed interest rates offer peace of mind. A variable rate loan is only worthwhile if you expect market interest rates to fall soon, giving you the opportunity to save money.

However, student loan refinancing lenders anticipate these market changes when they offer you initial interest rates, so it may be safer to choose a fixed rate.

After completing the terms and signing the agreement, your new lender will repay your original loan. If you have multiple student loans, the lender will combine them and pay them off, leaving you with just the new loan to refinance.

This is known as student loan consolidation, where multiple loans are combined into one easy-to-manage loan with new terms and conditions.

Discover Personal Loans Review 2024

With this consolidation, you will make monthly payments to your new lender according to the agreed terms. If you choose a lower interest rate or longer repayment term, your monthly payments can be lower, giving you more budget flexibility.

There are usually no origination fees or hidden fees. You will continue to make regular loan and interest payments, but they will now go to the new lender.

Consistent on-time payments are critical to building a positive credit history, especially if you plan to refinance several times. As your credit score improves, you may qualify for better interest rates each time you refinance your loan.

Private student loan refinancing can benefit you if done correctly and at the right time. Here are some examples of when refinancing may be beneficial:

Best Big Banks For Refinancing Student Loans In 2024

Adding a cosigner can increase your chances of approval and help you get a better rate, especially if you don’t have strong credit or a stable income.

Remember to ask your lender if they offer a collateral release option after a certain period of on-time payment.

Refinancing student loans is a great way to ease your financial burden and manage your student loan debt. However, it takes a little research to choose the right terms, rates, and lender.

Book a consultation with our team of refinancing experts and we’ll help you make the best decision to suit your financial goals.

Splash Financial Student Loan Refinancing Review

Brandon Barfield is President and Co-Founder of Student Loan Professors and is nationally known as an expert on student loans for the graduate health professions. Since 2011, Brandon has given hundreds of presentations on loan repayment at schools, hospitals, and medical conferences across the country. With his diverse experience in financial aid, financial planning, and student loan counseling, Brandon has extensive knowledge of the complexities surrounding student loans, loan repayment strategies, and how they should be considered when graduates make other financial decisions.

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept”, you agree to the use of ALL cookies.

This website uses cookies to improve your experience while you navigate through the website. Out of these, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. We also use third-party cookies to help us analyze and understand how you use this website. These cookies will be stored in your browser only with your consent. You also have the option to opt-out of these cookies. But opting out of some of these cookies may affect your browsing experience. Find our privacy policy.

Necessary cookies are essential for the website to function properly. These cookies ensure basic functionality and security features of the website, anonymously.

Refinancing Student Loans After Student Loan Forbearance

This cookie is set by the GDPR Cookie Consent Plugin. The cookie is used to store the user’s consent to cookies in the “Analytics” category.

Cookies are set by the GDPR Cookie Consent to record the user’s consent to cookies in the “Functional” category.

This cookie is set by the GDPR Cookie Consent Plugin. The cookie is used to store the user’s consent to cookies in the “Other” category.

This cookie is set by the GDPR Cookie Consent Plugin. Cookies are used to store the user’s consent to cookies in the “Required” category.

5 Banks That Refinance Student Loans

This cookie is set by the GDPR Cookie Consent Plugin. The cookie is used to store the user’s consent to cookies in the “Performance” category.

Cookies are set by the GDPR Cookie Consent plugin and are used to store whether the user agrees to the use of cookies or not. It does not store any personal data.

Functional cookies help perform certain functions such as sharing website content on social media platforms, collecting comments and other third party functions.

Performance cookies are used to understand and analyze key website performance indices, helping to provide visitors with a better user experience.

Supreme Court Ruling On Student Loans: What To Do About It

Google Universal Analytics sets this cookie to speed up request rates and limit data collection on high-traffic sites.

Analytical cookies are used to understand how visitors interact with the website. These cookies help provide information about metrics: number of visitors, bounce rate, traffic sources, etc.

This cookie is set by Google Analytics. Cookies are used to calculate visitor, session and campaign data and track site usage for site analytics reports. Cookies store information anonymously and assign a randomly generated number to identify unique visitors.

This cookie is set by Google Analytics. Cookies are used to store information about how visitors use a website and help create analytical reports on website performance. The data collected, including the number of visitors, source of arrival, and pages visited, is done anonymously.

Sallie Mae Vs. Discover Student Loans

Advertising cookies are used to provide relevant advertising and marketing campaigns to visitors. These cookies track visitors across websites and collect information to provide personalized advertising.

Other uncategorized cookies are cookies that are being analyzed and have not yet been classified into a category. Initial purchase APR is x%

Discover student loans refinance, discover student loan refinance, discover refinance home loan, discover loan student, discover personal loan refinance, discover card student loan refinance, student loan refinance loan, student loan refinance bank, discover student loan refinance rates, discover refinance auto loan, discover bank student loan, discover loan refinance