What factors impact the cost of your life insurance premium? – When it comes to securing your loved ones’ financial future, life insurance is a crucial consideration. However, navigating the complexities of life insurance premiums can be daunting. This article delves into the intricate web of factors that impact the cost of your life insurance premium, empowering you with the knowledge to make informed decisions.

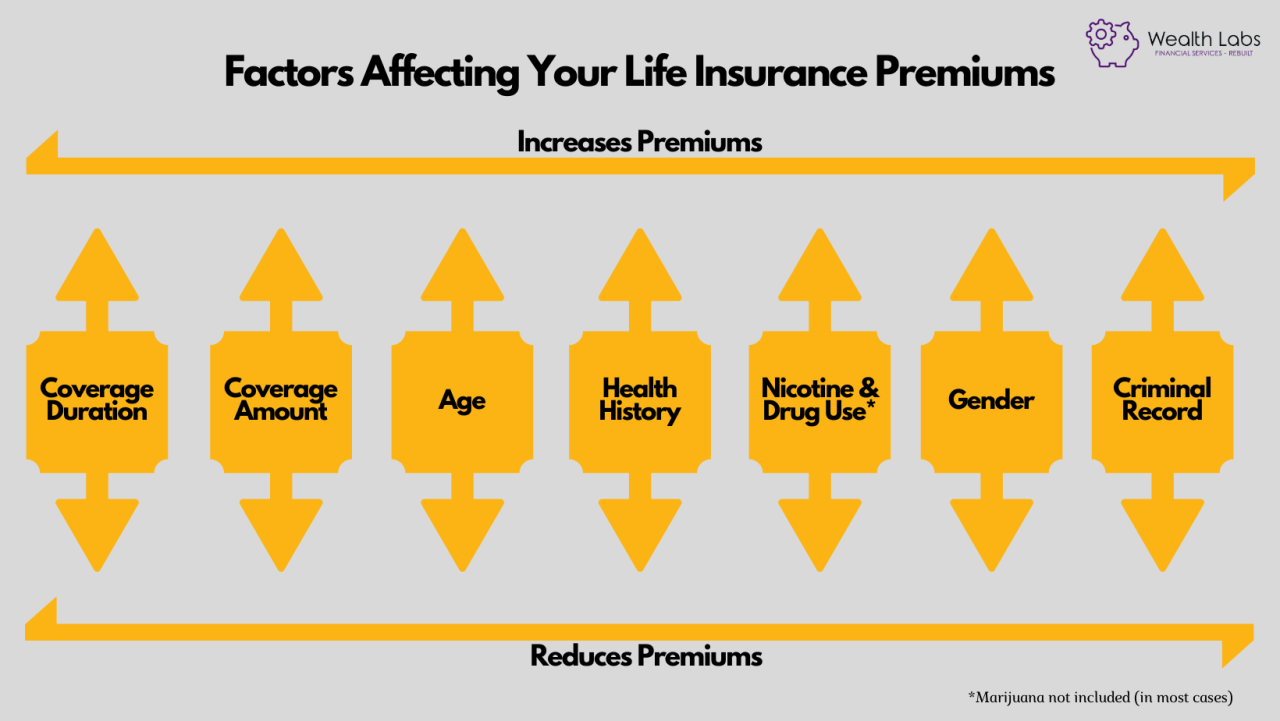

From age and health status to coverage amount and policy type, a myriad of variables come into play when determining your premium. Understanding these factors will not only help you optimize your coverage but also ensure you get the best value for your money.

Age: What Factors Impact The Cost Of Your Life Insurance Premium?

Age is a key factor in determining the cost of your life insurance premium. The younger you are, the lower your premium will be. This is because younger people are considered to be a lower risk to insurance companies. They are less likely to die prematurely, so the insurance company is less likely to have to pay out on their policy.

The cost of your life insurance premium can be impacted by a variety of factors, including your age, health, and lifestyle. There are also two main types of life insurance policies: term life insurance and whole life insurance. Term life insurance provides coverage for a specific period of time, while whole life insurance provides coverage for your entire life.

The type of policy you choose will also affect the cost of your premium. Click here to learn more about the two types of life insurance policies.

As you get older, your premium will increase. This is because you are more likely to die prematurely, so the insurance company is more likely to have to pay out on your policy.

Example

- A 20-year-old male can expect to pay around $20 per month for a $250,000 life insurance policy.

- A 40-year-old male can expect to pay around $40 per month for the same policy.

- A 60-year-old male can expect to pay around $80 per month for the same policy.

Health Status

Your health status is a major factor that impacts your life insurance premium. Insurance companies assess your risk of developing health problems in the future, which can affect how much you pay for coverage.

Some of the health conditions that can impact your premium include:

- Heart disease

- Cancer

- Stroke

- Diabetes

- Obesity

Your lifestyle factors can also affect your premium. For example, if you smoke, drink alcohol excessively, or have a high-risk occupation, you may pay more for coverage.

According to a study by the National Bureau of Economic Research, smokers pay an average of 40% more for life insurance than non-smokers. People who are overweight or obese pay an average of 15% more for coverage.

Coverage Amount

The coverage amount you choose for your life insurance policy significantly impacts your premium. The higher the coverage amount, the higher your premium will be. This is because the insurance company is taking on more risk by providing you with a larger death benefit.

- Example: Let’s say you are a 30-year-old male in good health. If you purchase a $250,000 policy, your premium will be around $20 per month. However, if you increase your coverage amount to $500,000, your premium will jump to around $40 per month.

Premium Differences for Various Coverage Amounts

The following table demonstrates the premium differences for various coverage amounts:

| Coverage Amount | Premium |

|---|---|

| $250,000 | $20 per month |

| $500,000 | $40 per month |

| $1,000,000 | $80 per month |

Policy Type

Life insurance policy types significantly influence the cost of your premium. Understanding the distinctions between various policies is crucial for selecting the most suitable and cost-effective option for your needs.

The two main types of life insurance policies are term life insurance and whole life insurance.

Term Life Insurance

Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years. If the policyholder passes away during the term, the beneficiaries receive the death benefit. However, if the policyholder outlives the term, the coverage expires, and there is no cash value or payout.

Term life insurance is generally the most affordable option because it only provides coverage for a limited time. The premiums are calculated based on the policyholder’s age, health status, and the length of the term.

Factors that impact the cost of life insurance premiums include age, health, lifestyle, and occupation. For those seeking additional coverage, supplemental life insurance can provide extra protection, but it’s essential to consider its impact on your overall premium costs. Understanding these factors empowers you to make informed decisions and optimize your life insurance coverage to suit your specific needs and budget.

Whole Life Insurance

Whole life insurance provides coverage for the entire life of the policyholder, regardless of when they pass away. In addition to a death benefit, whole life insurance also accumulates a cash value component that grows over time. The policyholder can borrow against the cash value or withdraw it for various purposes, such as retirement or education expenses.

When it comes to life insurance premiums, there are numerous factors that can affect their cost. Understanding the impact of factors like age, health, and lifestyle choices is crucial. However, it’s also essential to consider the differences between life insurance and accidental death and dismemberment (AD&D) insurance.

AD&D vs life insurance policies vary significantly in coverage and premiums. Therefore, carefully evaluating your specific needs and circumstances is paramount when determining the most suitable insurance option for you and your family. Ultimately, the cost of your life insurance premium is a reflection of the level of protection and coverage you desire.

Whole life insurance is more expensive than term life insurance because it provides lifelong coverage and includes a cash value component. The premiums are higher to account for the longer coverage period and the potential growth of the cash value.

Comparison of Policy Types

The following table Artikels the key features and premium differences between term life insurance and whole life insurance:

| Feature | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Coverage Period | Specific term (e.g., 10, 20, 30 years) | Entire life of the policyholder |

| Death Benefit | Paid if the policyholder dies during the term | Paid whenever the policyholder dies |

| Cash Value | No cash value | Accumulates over time |

| Premiums | Generally lower | Generally higher |

Ultimately, the best life insurance policy type for you depends on your individual needs and financial situation. If you need affordable coverage for a specific period, term life insurance may be a suitable option. If you prefer lifelong coverage and the potential for cash value growth, whole life insurance may be a better choice.

Occupation

Certain occupations may lead to higher life insurance premiums due to increased risk. This is because insurance companies assess the likelihood of an individual filing a claim based on their occupation and the associated risks involved. Occupations that involve hazardous activities, such as construction workers, firefighters, and police officers, typically carry higher risk and can result in higher premiums.

Examples of High-Risk Occupations

* Construction Workers: Engage in physically demanding tasks, work at heights, and operate heavy machinery, increasing the risk of accidents and injuries.

* Firefighters: Regularly exposed to extreme heat, smoke, and hazardous materials, posing significant health and safety risks.

* Police Officers: Face potential dangers during confrontations, traffic stops, and other law enforcement duties, increasing the likelihood of injuries or fatalities.

Gender

Historically, gender has played a significant role in determining life insurance premiums. Women have traditionally paid lower premiums than men, reflecting the perception that they have a longer life expectancy and are less likely to engage in risky behaviors. However, in recent years, the gender gap in life insurance premiums has narrowed as insurers have recognized that women’s life expectancies are increasing and that they are more likely to lead healthy lifestyles.

Several factors contribute to the gender-based differences in life insurance premiums. These include:

- Women have a longer life expectancy than men, on average. This is due to a combination of biological and social factors, including lower rates of heart disease, stroke, and cancer.

- Men are more likely to die from accidents, homicides, and suicides.

Health Status

- Women are more likely to be in good health than men. They are less likely to smoke, drink alcohol excessively, or engage in other risky behaviors.

- Men are more likely to have chronic health conditions, such as heart disease, diabetes, and cancer.

Occupation

- Women are more likely to work in less hazardous occupations than men.

- Men are more likely to work in occupations that involve heavy lifting, exposure to dangerous chemicals, or other risks.

Family History

Your family history can significantly impact your life insurance premiums. If you have a family history of certain medical conditions, you may be considered a higher risk by insurance companies and charged a higher premium as a result.

Some specific conditions that may impact insurance costs include:

Heart Disease

- Coronary artery disease

- Heart attack

- Stroke

Cancer

- Breast cancer

- Prostate cancer

- Lung cancer

Diabetes

- Type 1 diabetes

- Type 2 diabetes

Smoking Status

Smoking is a major risk factor for various health conditions, including cancer, heart disease, and stroke. As a result, smokers typically pay higher life insurance premiums compared to non-smokers.

According to a study published in the journal JAMA Internal Medicine, smokers pay an average of 40% more for life insurance than non-smokers. The study also found that the risk of death for smokers is more than twice that of non-smokers.

Impact on Premiums

- Smokers pay higher premiums because they have a higher risk of developing health problems that could lead to death.

- The amount of the premium increase depends on several factors, including the smoker’s age, health status, and the amount of coverage they are seeking.

- In general, younger smokers pay a higher premium increase than older smokers because they have a longer life expectancy and a greater chance of developing health problems.

- Smokers who are in poor health also pay a higher premium increase than smokers who are in good health.

Closing Summary

In conclusion, the cost of your life insurance premium is a multifaceted equation influenced by a range of factors. By carefully considering these variables, you can tailor your policy to meet your specific needs and budget, providing peace of mind for yourself and your loved ones.

thanks for insurance information…glad to read this articles now….